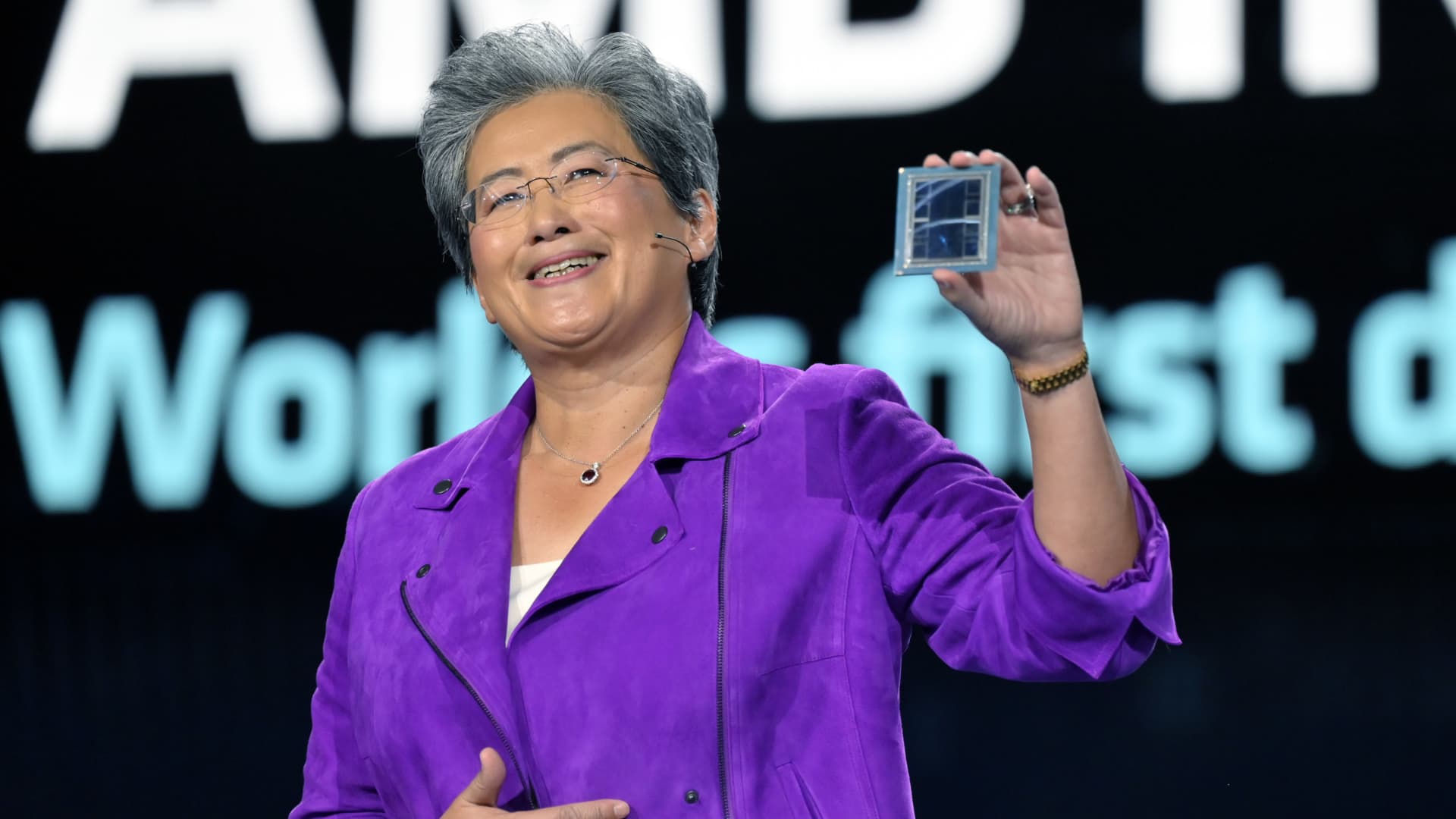

Lisa Su shows an AMD Intuition MI300 chip as she delivers a keynote tackle at CES 2023 in Las Vegas, Nevada, on Jan. 4, 2023.

David Becker | Getty Photographs

Demand for graphics processing models — the synthetic intelligence chips that energy packages akin to ChatGPT — has been surging for months, resulting in vital features for the businesses that make GPUs.

AMD rose almost 130% in 2023, as traders wager that the corporate’s AI-oriented GPUs scheduled to ship this yr can take market share from Nvidia and supply an alternate for large patrons like Microsoft and Meta.

However elevated expectations for AI chip development has led Northland Capital Markets analyst Gus Richard to confess that he is undecided the place AMD shares ought to go from right here.

“We downgrade on valuation to ‘a heck if we all know’ ranking,” Richard wrote in a notice on Monday. He mentioned he has an precise ranking of market carry out, which is equal to a maintain.

Richard’s name relies on his view that investor expectations for AI chip development have spilled into “irrational exuberance.” He predicts complete AI chip income of $125 billion in 2027 and says the vary of expectations is so nice that some analysts are estimating $100 billion and others are at $400 billion.

“AI is huge, it is actually huge, simply not as huge as traders are pondering,” Richard wrote.

Richard mentioned that general demand alerts had been distorted for a number of causes. First, market chief Nvidia was successfully a “sole supply” for AI chips and demand has been outstripping provide. That led to prospects “double ordering,” or shopping for upfront greater than they wanted. He additionally cites latest strikes from the U.S. to ban sure chip exports to China as one thing that would weigh on development.

In Richard’s calculation, If AMD had been to promote $16 billion in AI chips in 2027 — doubling yearly from $1 billion in 2024 — the corporate would have a few 13% market share and would proceed to spend extra on analysis and growth to maintain up with Nvidia. He sees $45 billion in complete 2027 income for AMD and says that determine is already priced into the inventory.

AMD shares fell about 3.5% to $168.17 as of Monday afternoon. Nvidia shares had been up lower than 1%.

WATCH: Jim Breyer says he would add AMD to the ‘Magnificent Seven’