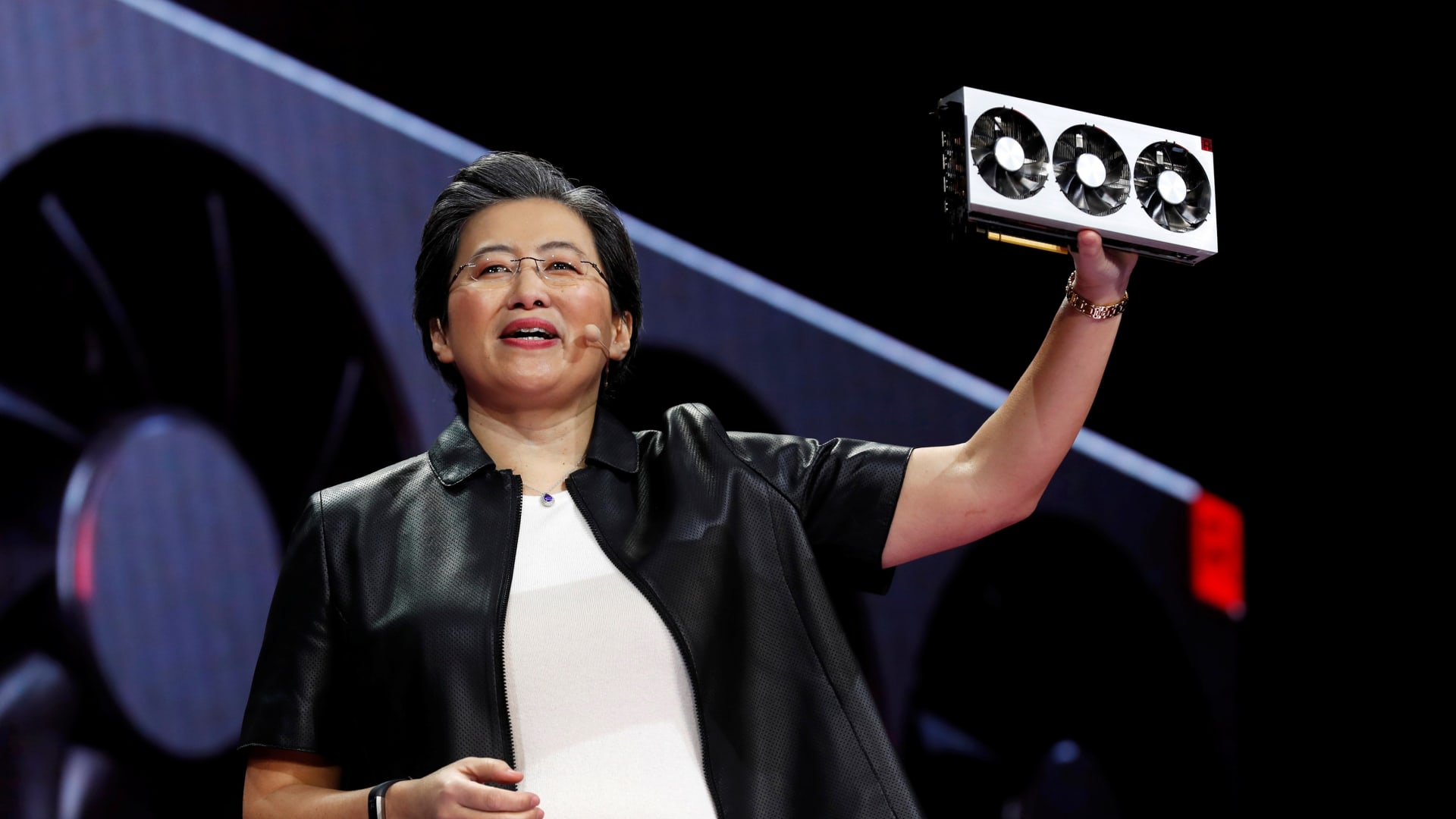

Lisa Su, president and CEO of AMD, talks concerning the AMD EPYC processor throughout a keynote handle on the 2019 CES in Las Vegas, Nevada, U.S., January 9, 2019.

Steve Marcus | Reuters

AMD reported fourth-quarter earnings on Tuesday that have been in step with analyst expectations, whereas the corporate’s income beat estimates, however AMD provided a first-quarter forecast that fell in need of expectations.

AMD inventory slid greater than 3% in prolonged buying and selling.

Here is how the corporate did versus LESG (previously Refinitiv) consensus estimates for the quarter resulted in December:

- EPS: $0.77 per share, adjusted, versus $0.77 per share anticipated

- Income: $6.17 billion, versus $6.12 billion anticipated

For the primary quarter, AMD stated it expects about $5.4 billion in gross sales, plus or minus $300 million, whereas analysts have been in search of income of $5.73 billion. AMD added that it anticipated a few of its main companies, together with PC chips, to say no sequentially throughout the quarter. It stated that its knowledge middle income can be flat as server chip declines can be offset by AI GPU gross sales.

Internet revenue within the fourth quarter was $667 million, or $0.41 per share, versus $21 million, or $0.01 per share a 12 months in the past.

AMD makes graphics processing items, or GPUs, that are wanted to coach and deploy generative synthetic intelligence fashions. Whereas that market is at the moment dominated by Nvidia, AMD has stated that its new AI chips launched final 12 months will problem Nvidia’s H100 GPUs for some purposes, and buyers are in search of important progress within the firm’s knowledge middle phase over the subsequent few years.

In October, AMD stated it anticipated $2 billion in server GPU gross sales in 2024.

However traditionally, AMD’s foremost enterprise has been central processors, or CPUs, for PCs and servers. In comparison with AI chips, that a part of the semiconductor trade has been flat or shrinking over the previous few years, as PC gross sales have suffered post-pandemic.

Knowledge middle, which incorporates server CPUs and AI chips, rose 38% on an annual foundation to $2.28 billion in gross sales. It is now firmly AMD’s largest enterprise and the corporate stated that a lot of the rise in income was attributable to “sturdy progress” for gross sales of its Intuition graphics processors, that are used for AI.

Nevertheless, AMD’s total efficiency within the enterprise was in step with a $2.29 billion FactSet estimates for the Knowledge Middle enterprise.

AMD’s consumer group, which is comprised principally of chips for PCs and laptops, rose 62% year-over-year to $1.46 billion in gross sales, which the corporate stated was boosted by current chip launches.

Gross sales in AMD’s gaming phase, which incorporates “semi-custom” processors for Microsoft Xbox and Sony Ps consoles, fell 17%. AMD blamed slower console gross sales, and stated it anticipated semi-custom income to say no by a “important” double-digit share within the present quarter.

AMD’s embedded phase, which incorporates chips for networking, reported $1.1 billion in gross sales, down 24% on an annual foundation.