Marc Andreessen and Ben Horowitz

Getty Photos

Andreessen Horowitz mentioned Tuesday that it raised $7.2 billion throughout 5 totally different funds, an indication of optimism within the tech startup world, which has seen a dearth of great exits over the previous two years.

“This marks an vital milestone for us,” Ben Horowitz, who co-founded the agency with Marc Andreessen in 2009, wrote in a weblog submit.

The most important chunk of latest funding is in Andreessen Horowitz’s progress fund, which reeled in $3.75 billion. That cash will get invested in later-stage corporations which are considered as nearer to going public, or capital-intensive companies that require huge checks.

Horowitz mentioned within the submit that $1.25 billion will probably be devoted to infrastructure, which incorporates synthetic intelligence investments, whereas $1 billion will go to app investments, $600 million to video games and one other $600 million to what the agency calls American Dynamism, or “founders and corporations that assist the nationwide curiosity.” That features aerospace, protection, training and housing.

The agency had initially aimed to boost $6.9 billion from buyers for a brand new set of funds, together with two with an AI focus, Bloomberg beforehand reported. AI investing has been pink sizzling in Silicon Valley and past, whereas the broader market has been in a downturn.

Since 2021, when tech IPOs and startup investing surged to a file, enterprise buyers have closed their wallets. Hovering inflation and rising rates of interest in 2022 pushed buyers out of dangerous property and compelled cash-burning startups to dramatically minimize prices. Even with the inventory market recovering, enterprise offers have remained depressed.

Deal quantity for U.S. enterprise investments within the first quarter sank to its lowest degree since 2017, based on knowledge revealed earlier this month by PitchBook. The story was comparable throughout the globe, with worldwide quantity reaching its lowest since 2016 and complete deal worth falling to a degree not seen since 2019.

In the meantime, there have been only a few tech IPOs for the reason that finish of 2021. Reddit and Astera Labs went public within the first quarter, the primary venture-backed tech corporations to debut since September. They accounted for 73.4% of complete exit worth within the U.S. within the interval, based on PitchBook.

Horowitz made no reference to the market slowdown in his submit. Nor did he counsel that any new funding will probably be devoted to cryptocurrencies, an space the place Andreessen Horowitz was notably bullish throughout the crypto craze that lifted bitcoin to a file in 2021. The agency raised a $4.5 billion crypto fund in 2022, bringing its complete quantity raised for crypto and blockchain investments to $7.6 billion.

Andreessen Horowitz stays on monitor to boost extra money for its crypto fund and a separate biotechnology fund, an individual aware of the matter advised Bloomberg. The agency did not instantly reply to a request for remark.

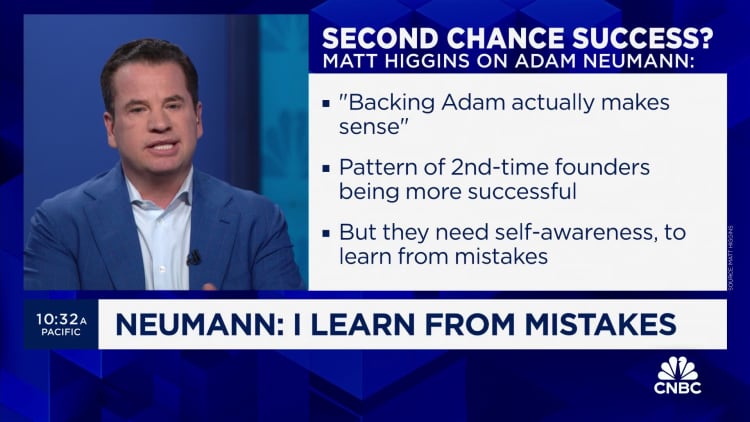

Considered one of Andreessen Horowitz’s extra notable bets of the previous couple years concerned WeWork’s controversial co-founder Adam Neumann and his new startup known as Move. Andreessen Horowitz wrote a $350 million examine to the corporate, which was simply getting began and has but to make inroads within the residential actual property market.

Andreessen Horowitz mentioned in a weblog submit on the time that Neumann’s efforts to revamp the workplace expertise at WeWork are “usually underneath appreciated” and that the agency loves “seeing repeat-founders construct on previous successes by rising from classes discovered.”

WATCH: Adam Neumann deserves second shot, CEO says