A WeWork co-working workplace area in New York, US, on Tuesday, Nov. 7, 2023.

Yuki Iwamura | Bloomberg | Getty Pictures

WeWork, the shared workplace area firm as soon as valued at $47 billion, emerged from chapter on Tuesday and named Cushman & Wakefield govt John Santora as its new CEO.

WeWork filed for Chapter 11 chapter safety in November, with whole liabilities of $18.65 billion in opposition to property of $15.06 billion. The Covid-19 pandemic, which led to a surge in vacancies, coupled with an financial droop and steep downturn in tech valuations, contributed to WeWork’s troubles.

Santora turns into WeWork’s fourth everlasting CEO in 5 years after the corporate’s failed preliminary public providing in 2019 and subsequent restructuring. He replaces David Tolley, who started service as interim CEO in Might 2023 earlier than assuming the everlasting position in October. The announcement comes greater than per week after WeWork’s goal exit date of Might 31. WeWork additionally introduced a brand new board, together with Anant Yardi, CEO of property administration software program firm Yardi Methods.

Throughout Tolley’s transient tenure, WeWork entered chapter safety. The corporate has since renegotiated greater than 190 leases and exited greater than 170 “unprofitable” places, in line with an organization launch.

Santora beforehand served as Cushman & Wakefield‘s Tri-State chairman and leaves the business actual property agency after 40 years.

The downsizing of WeWork’s actual property portfolio diminished annual lease and tenancy bills by greater than $800 million, and the corporate additionally secured $400 million of extra fairness capital. WeWork stated final week that its portfolio now consists of about 45 million sq. toes in 600 places throughout 37 international locations.

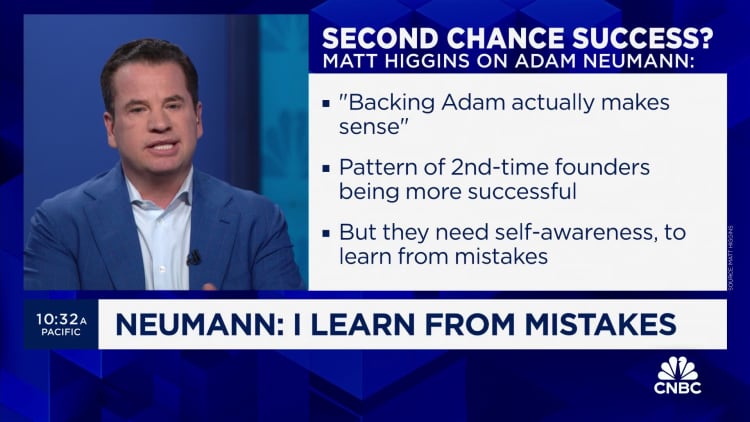

WeWork was based in 2010 by Adam Neumann and Miguel McKelvey. Neumann led the corporate by years of historic development and large financing rounds. He was ousted in 2019 quickly after WeWork’s IPO prospectus was launched. The corporate finally went public in 2021 by a particular function acquisition firm (SPAC), earlier than fairness holders had been worn out two years later.