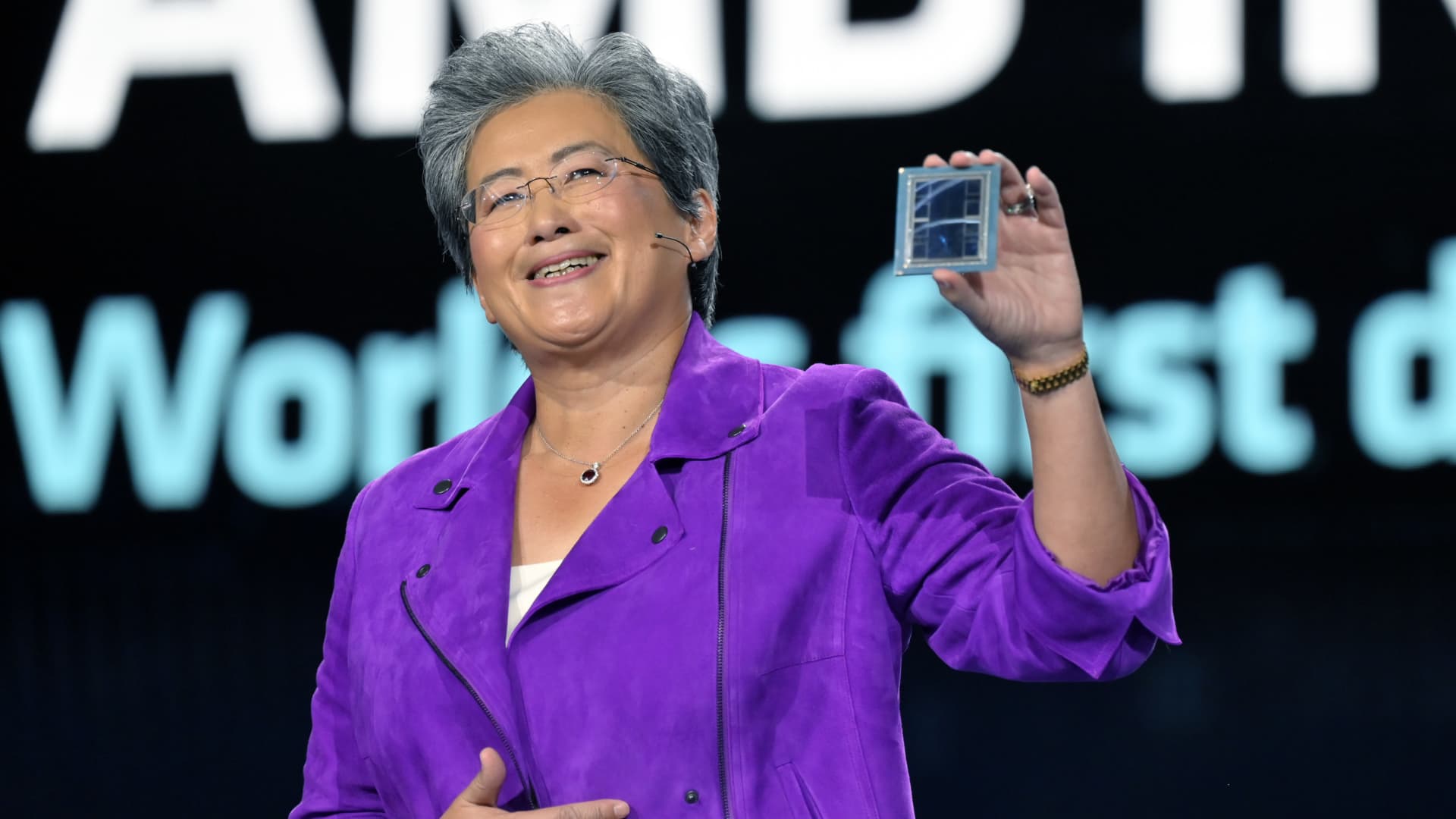

Lisa Su shows an AMD Intuition MI300 chip as she delivers a keynote deal with at CES 2023 in Las Vegas, Nevada, on Jan. 4, 2023.

David Becker | Getty Pictures

AMD shares rose greater than 8% Tuesday to their highest closing worth since reaching a document in November 2021, on optimism that the corporate’s synthetic intelligence chips will likely be in increased demand from firms resembling Microsoft, Google and OpenAI.

Tom O’Malley, an analyst at Barclays, raised his worth goal on AMD to $200 from $120, saying AMD might publish $4 billion in AI chip gross sales this 12 months. O’Malley, who has the equal of a purchase score on the inventory, cited sturdy demand for the MI300, AMD’s highest-end machine studying chip for servers.

KeyBanc analysts additionally elevated their worth goal for AMD to $195 and Nvidia to $740 on Tuesday, because of sturdy demand for AI servers.

AMD closed at $158.74 on Tuesday, roughly 2% beneath the inventory’s all-time excessive. Nvidia, which has the overwhelming majority of the marketplace for AI chips and was the best-performing inventory within the S&P 500 final 12 months, superior 3% to $563.82.

In late 2023, AMD introduced new server chips for AI to compete with Nvidia’s H100 and A100 GPUs, that are utilized by OpenAI to coach and serve its fashions such because the one on the coronary heart of ChatGPT.

AMD and Nvidia are the 2 main producers of graphics processing items, which have been invented for superior pc video games, however are actually vital to coach and run AI fashions. As AI purposes gained investor consideration over the previous two years, Nvidia has been the first beneficiary as a result of the corporate developed AI software program for its chips greater than 10 years in the past.

“They’ve constructed a software program layer round their chip that the businesses I put money into simply can’t get sufficient of,” Enterprise capitalist Jim Breyer informed CNBC on Tuesday.

Breyer mentioned he was “pounding the desk” for each Nvidia and AMD shares.

Analysts see AMD bettering its AI software program and anticipate main chip consumers resembling cloud suppliers and tech giants to look onerous at utilizing AMD GPUs.

“We’re on no account discounting the lead that NVDA has however we expect the need to have a second supply will overwhelm difficulties for the software program ecosystem,” O’Malley wrote.

WATCH: I’d add AMD to the ‘Magnificent Seven’

Do not miss these tales from CNBC PRO: