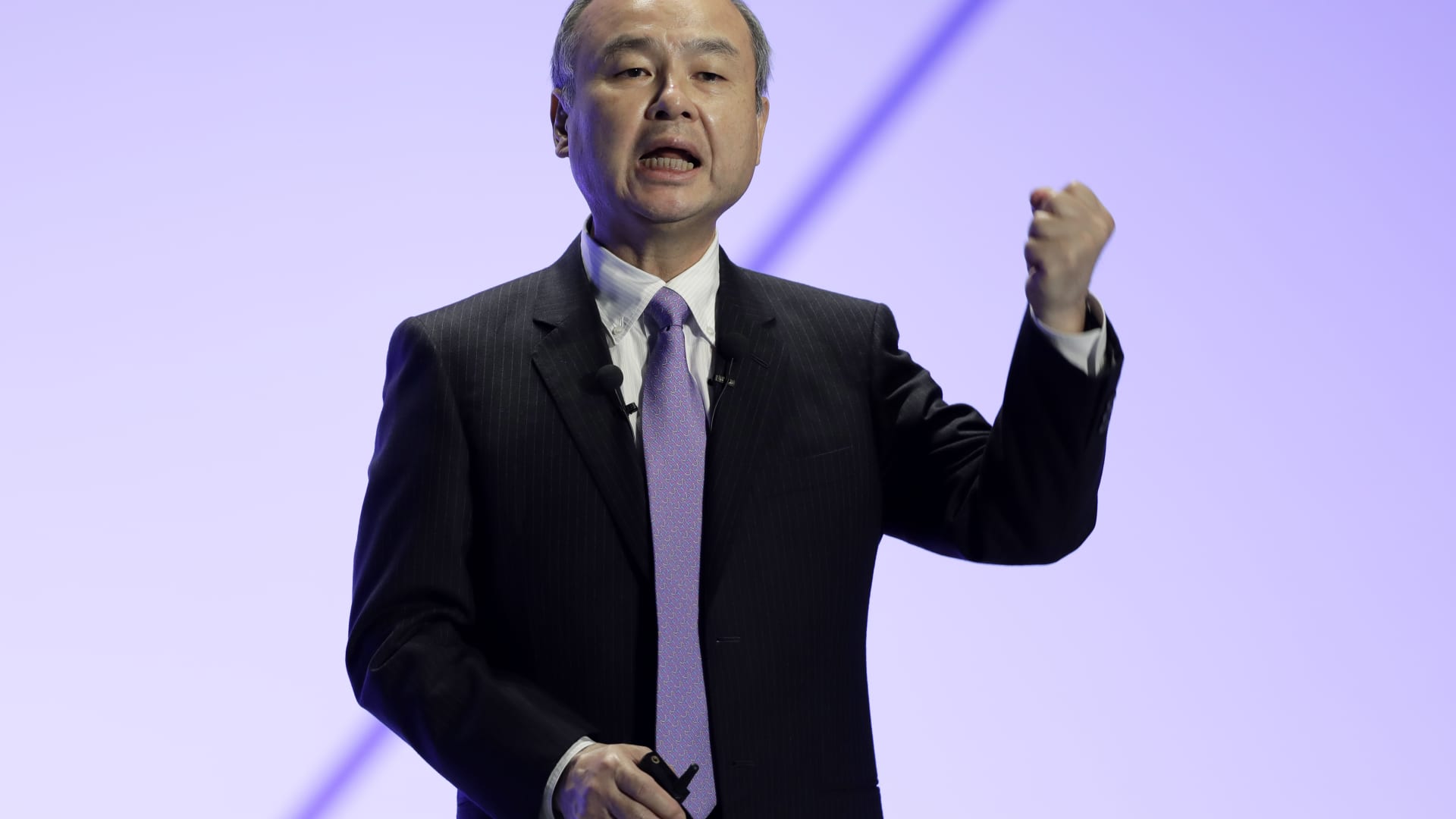

Masayoshi Son, chairman and CEO of SoftBank Group Corp.

Kiyoshi Ota | Bloomberg | Getty Photos

Arm shares soared 29% on Monday, extending final week’s rally as buyers proceed to applaud the chipmaker’s better-than-expected third-quarter earnings and its place within the synthetic intelligence growth.

Arm is now up 93% because it reported quarterly financials on Feb. 8, although with none clear catalyst for Monday’s transfer. The inventory has virtually tripled since Arm’s preliminary public providing in September, closing at $148.97, and is now value virtually $153 billion, or slightly greater than $30 billion beneath Intel’s market cap.

Final week, Arm stated it might cost twice as a lot for its newest instruction set, which accounts for 15% of the corporate’s royalties, suggesting it may develop its margin and make more cash off new chips. It additionally stated it was breaking into new markets, akin to cloud servers and automotive, because of AI demand.

Its royalty energy mixed with Arm’s optimistic progress forecast has made the corporate the most recent AI darling amongst buyers, regardless of the next earnings a number of than Nvidia or AMD.

Nonetheless, Arm’s worth could grow to be clearer subsequent month when the 180-day post-IPO lockup expires. SoftBank nonetheless owns 90% of the excellent inventory, which means its stake in Arm has elevated greater than $61 billion for the reason that firm’s report final week and is now value upward of $131 billion.

For the second time in three buying and selling classes, Arm’s each day quantity exceeded 100 million shares, or greater than 10 occasions the typical for the inventory .

WATCH: Arm have a really clear AI story that can result in progress

Do not miss these tales from CNBC PRO: