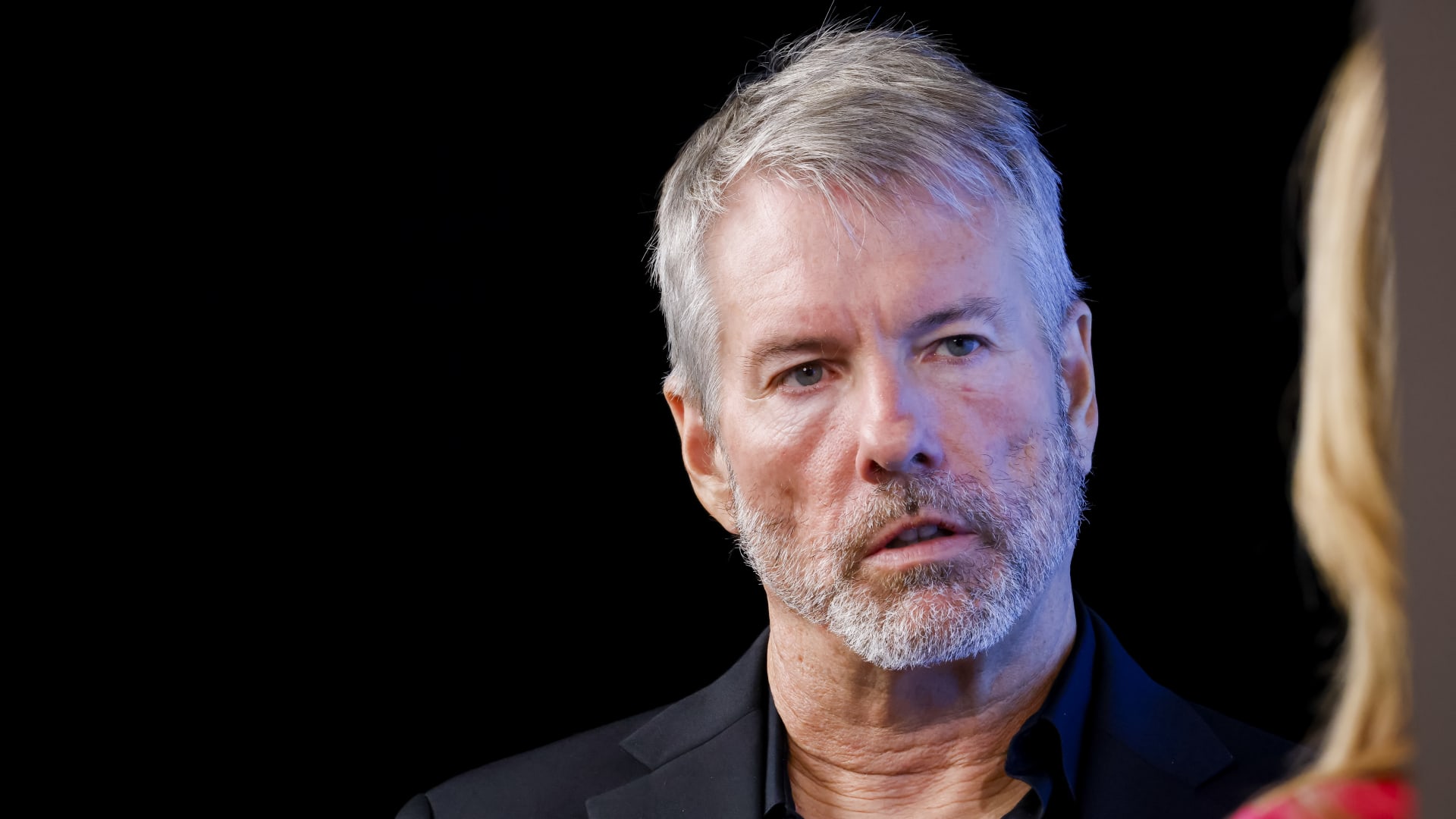

Michael Saylor, chairman and chief government officer at MicroStrategy, throughout an interview on the Bitcoin 2023 convention in Miami Seashore, Florida, US, on Thursday, Might 18, 2023.

Eva Marie Uzcategui | Bloomberg | Getty Pictures

MicroStrategy founder and bitcoin evangelist Michael Saylor entered right into a stock-sale plan together with his firm final summer time that allowed him to unload as much as 400,000 shares within the first 4 months of 2024.

It was a well timed settlement for the 59-year-old crypto billionaire.

With the plan greater than 90% of the best way to completion, Saylor has netted about $370 million from this yr’s inventory gross sales, due to the stratospheric rise in worth of MicroStrategy, which is successfully a bitcoin holding firm.

Saylor, who began MicroStrategy in 1989 as a software program and tech consulting enterprise and nonetheless serves as chairman, has emerged as a bitcoin hero lately, telling CNBC final month the cryptocurrency goes to “eat gold.” His firm has used its steadiness sheet and tapped the capital markets to accumulate greater than 214,000 bitcoins since saying its technique to enter the crypto market in mid-2020.

These belongings, equal to about 1% of the full variety of bitcoins minted up to now, at the moment are price about $13.6 billion, accounting for the majority of MicroStrategy’s $21.3 billion market cap. The inventory has been a Wall Avenue darling of late, climbing 91% this yr — regardless of a 37% pullback from its March excessive — after hovering 346% in 2023, among the best performers throughout the U.S. inventory market.

Saylor is the biggest MicroStrategy shareholder, with Class B holdings price about $2.3 billion. On the finish of 2023, Saylor owned one other 400,000 Class A shares as a consequence of an possibility he acquired in 2014. These are the shares he is promoting with velocity.

Buried close to the tip of its third-quarter earnings submitting on Nov. 1, MicroStrategy introduced that the corporate and Saylor had entered into an settlement, referred to as a 10b5-1 plan, in September, permitting the founder to promote as many as 5,000 shares each buying and selling day from Jan. 2 to April 25 of this yr, as much as a complete of 400,000 shares. The shares had been tied to a “vested inventory possibility, which expires if unexercised on April 30, 2024.”

As of this week, Saylor has offered 370,000 shares totaling $372.7 million, based on filings. His Class A holdings are all the way down to 30,000 shares as of the newest sale disclosed on Thursday.

MicroStrategy did not reply to requests for remark.

Mark Palmer, an analyst at Benchmark, referred to as the inventory gross sales “solely programmatic” due to the buying and selling plan executed final yr and in no way a mirrored image of Saylor’s confidence in MicroStrategy or his view of the inventory worth.

There is a differing view within the retail investor world, nevertheless. Quite a few posts on Reddit counsel that Saylor is probably promoting for different causes, with some members of the r/MSTR subreddit speculating that he is utilizing the money to purchase bitcoin instantly. Some say they’re promoting together with Saylor. The inventory is down 29% in April, whereas bitcoin has dropped 11%.

‘Straightforward sufficient to seek out the reality’

Palmer, who has a “purchase” score on the inventory, countered that such a standpoint “could be a misinterpret” by traders and merchants.

“What we’re seeing right here may be very easy and all of it has been disclosed already,” Palmer mentioned. “It is easy for many who both might not perceive the main points or those that perceive the main points however may need a brief on the inventory to twist issues round a bit. As is usually the case, it is simple sufficient to seek out the reality.”

Even with the inventory gross sales, nearly all of Saylor’s wealth stays wrapped up in his Class B holdings of MicroStrategy, together with the 17,732 bitcoins he bought in 2020 which are presently price about $1.1 billion.

A lot of the rally in bitcoin and associated investments has to do with the emergence of bitcoin exchange-traded funds, which acquired regulatory approval earlier this yr, and the upcoming halving this week. The technical occasion occurs each 4 years, slicing rewards for bitcoin miners in half and decreasing the tempo at which new bitcoins enter the market.

In a market the place customers can purchase bitcoin instantly on varied exchanges or select a number of recent ETFs, Saylor has mentioned the continuing benefit of MicroStrategy is that it is a leveraged bitcoin play with out the administration payment. The corporate can increase cash to go deeper in crypto, and final month mentioned it reeled in $782 million “to accumulate extra bitcoin.” The money got here from a convertible debt sale at 0.625% curiosity.

“Is there any firm on this planet that you just would not wish to spend money on that might borrow $1 billion at lower than 1% curiosity to spend money on your greatest concept?” Saylor mentioned on CNBC’s “Squawk Field” in March. He added that the corporate’s leverage results in volatility, which “attracts capital, and we will then leverage extra.”

Benchmark’s Palmer mentioned there are many causes to stay bullish on MicroStrategy, particularly with the halving simply across the nook. Following previous halving occasions, the worth of bitcoin has jumped.

“If I had been in a state of affairs the place I had shares in MicroStrategy, that is time the place I might very a lot wish to be holding on to them,” Palmer mentioned.