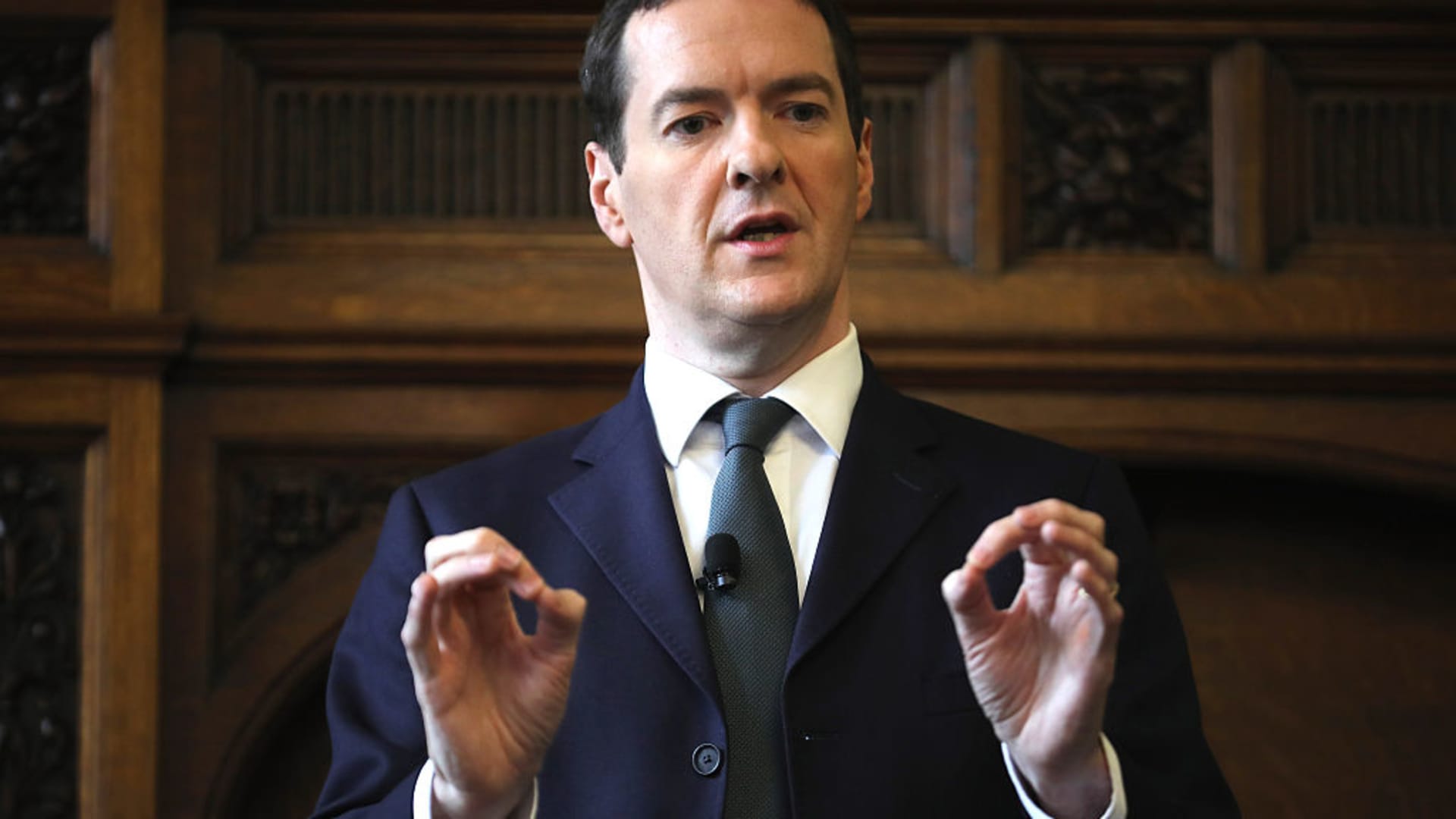

Former British Chancellor George Osborne addresses friends throughout a go to to the Manchester Chamber of Commerce on July 1, 2016 in Manchester, England.

Christopher Furlong | Getty Pictures

LONDON — A former British finance minister on Wednesday joined cryptocurrency trade Coinbase as a world advisor, beefing up the corporate’s regulatory bargaining energy at a time when it faces extreme scrutiny stateside.

Coinbase introduced that George Osborne, who served as Britain’s chancellor of the exchequer from 2010 to 2016, will be a part of the corporate on its world advisory council.

He’ll be a part of the likes of Mark Esper, the previous U.S. Secretary of Protection and Patrick Toomey (R-PA) on the council, which is in place to “advise Coinbase on our world technique as we develop our attain around the globe.”

Faryar Shirzad, Coinbase’s chief coverage officer, stated the corporate was “happy to have George be a part of our council at an thrilling time for us within the U.Ok. and globally.”

“George brings with him a wealth of expertise in enterprise, journalism and authorities. We look ahead to counting on his insights and experiences as we develop Coinbase around the globe,” Shirzard added.

Osborne will serve in an advisory capability at Coinbase, serving to join the corporate with politicians and regulators to assist additional the reason for forming crypto-friendly rules.

Whereas chancellor of the exchequer, Osborne launched a slew of austerity insurance policies aimed toward decreasing the finances deficit, together with freezing youngster advantages, decreasing housing advantages, and implementing a two-year pay freeze for public sector employees. He additionally tried to stimulate enterprise exercise by chopping company tax.

Osborne was quickly editor-in-chief at London’s Night Commonplace newspaper after finishing his tenure as Britain’s finance minister. He’s presently a accomplice at Robey Warshaw LLP, a boutique funding financial institution.

“There’s an enormous quantity of thrilling innovation in finance proper now,” Osborne stated. “Blockchains are remodeling monetary markets and on-line transactions.”

“Coinbase is on the frontier of those developments. I look ahead to working with the crew there as they construct a brand new future in monetary companies,” Osborne continued.

Osborne’s ties with Coinbase aren’t new

Ideas of a rising relationship between Osborne and Coinbase first emerged final 12 months, when Coinbase’s CEO Brian Armstrong spoke onstage in a fireplace moderated by Osborne at a fintech occasion in London.

Osborne subsequently spoke with Coinbase’s chief monetary officer, Alesia Haas, at a fireplace chat within the Belvedere Lodge throughout the World Financial Discussion board in Davos, Switzerland.

It comes as Coinbase has made one thing of a land seize throughout Europe, increasing in a number of international locations over the previous couple of months with new licenses in place. The corporate was granted a digital asset service supplier license in France final month, paving the way in which for enlargement of its companies there. It has additionally lately secured licenses in Spain, Singapore, and Bermuda.

Coinbase is presently dealing with a harsh regulatory crackdown within the U.S. the place the Securities and Trade Fee has accused the corporate of violating securities legal guidelines. Coinbase denies the allegations.

Final 12 months, Coinbase chief Armstrong appeared on stage with Osborne on the Innovate Finance International Summit convention in London. On the occasion, Armstrong stated he was open to investing extra overseas, together with relocating from the U.S. to the U.Ok. or elsewhere if the regulatory strain on crypto corporations continues.

“I feel if a lot of years go by the place we do not see regulatory readability round us … we might have to think about investing extra elsewhere on this planet. Something together with, you understand, relocating,” Armstrong informed Osborne.

He informed CNBC’s Arjun Kharpal on the time that Coinbase was ” different markets” because it considers its place from a regulatory standpoint.

Armstrong did later make clear in an interview with CNBC’s Dan Murphy that Coinbase had no formal plans to relocate from its U.S. headquarters in San Francisco. “Coinbase just isn’t going to relocate abroad,” Armstrong stated. “We’re at all times going to have a U.S. presence … However the U.S. is a little bit bit behind proper now.”