Folks have a good time the Gitlab IPO on the Nasdaq, October 14, 2021.

Supply: Nasdaq

GitLab shares rose 33% on Tuesday, after the supplier of code-deployment software program reported a narrower loss than analysts anticipated and bumped up its full-year forecast.

The inventory was headed for its greatest day since GitLab’s 2021 Nasdaq debut. It is nonetheless roughly 65% under its peak from November of that 12 months, the month that tech shares reached document ranges. After that, traders started shifting cash out of dangerous property on considerations of slowing development and rising rates of interest.

GitLab mentioned that income within the quarter ended April 30 jumped 45% to $126.9 million from $87.4 million a 12 months earlier. The corporate had an adjusted lack of 6 cents per share, in line with a press release. Analysts surveyed by Refinitiv had anticipated gross sales of $117.8 million and an adjusted lack of 14 cents per share.

GitLab’s internet loss widened to $52.9 million from $26.6 million within the year-ago quarter.

For the 2024 fiscal 12 months, GitLab sees an adjusted lack of 14 cents to 18 cents per share on income of $541 million to $543 million. Analysts had anticipated an adjusted lack of 26 cents per share and gross sales of $532.6 million. In March GitLab had known as for an adjusted per-share lack of 24 cents to 29 cents on income of $529 million to $533 million.

Throughout the quarter, GitLab raised the worth of its premium tier to $29 per person per 30 days from $19.

“Thus far, buyer churn is unchanged for the premium prospects who renewed in April,” GitLab finance chief Brian Robins mentioned on Monday’s name with analysts. He added that common annual recurring income per buyer “elevated consistent with our expectations.”

Sid Sijbrandij, GitLab’s CEO, mentioned extra income might come from a generative synthetic intelligence add-on that can value $9 per person per 30 days when billed yearly.

Sijbrandij, who co-founded the corporate over a decade in the past, had some encouraging private information to share. Three months after saying he had chosen to bear therapy for osteosarcoma, Sijbrandij mentioned on the decision that there was “no signal of detectable illness,” including that he is excited concerning the firm’s future and “retaining my position as CEO and chair.”

The enterprise nonetheless has challenges. Gross sales cycles took longer than standard throughout the quarter, and prospects lowered the variety of seats they purchased, Robins mentioned.

However the monetary numbers led a number of analysts to boost their worth targets on GitLab inventory.

“The quarter was stronger than most anticipated, and the corporate was in a position to keep a really constructive and conservative outlook — a distinction to final quarter,” wrote Piper Sandler analysts Rob Owens and Ethan Weeks in a word to purchasers.

The analysts have the equal of a purchase ranking on the corporate’s inventory and lifted their worth goal to $52 from $50. GitLab shares have been buying and selling at near $47 as of mid-afternoon New York time.

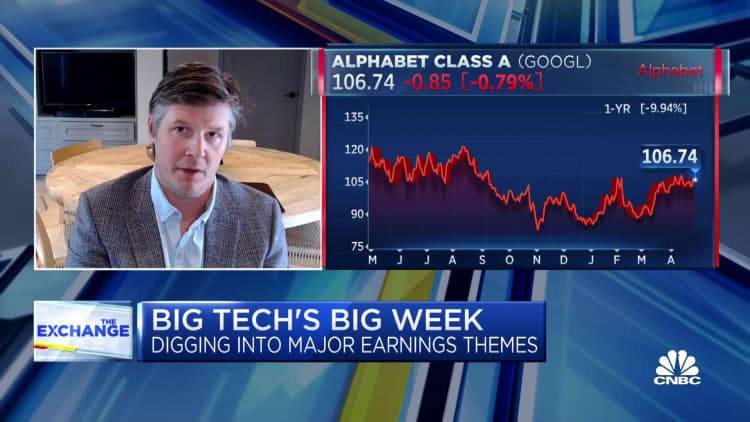

WATCH: Ongoing deceleration in IT spending shouldn’t be mirrored in tech earnings, says Jefferies’ Brent Thill