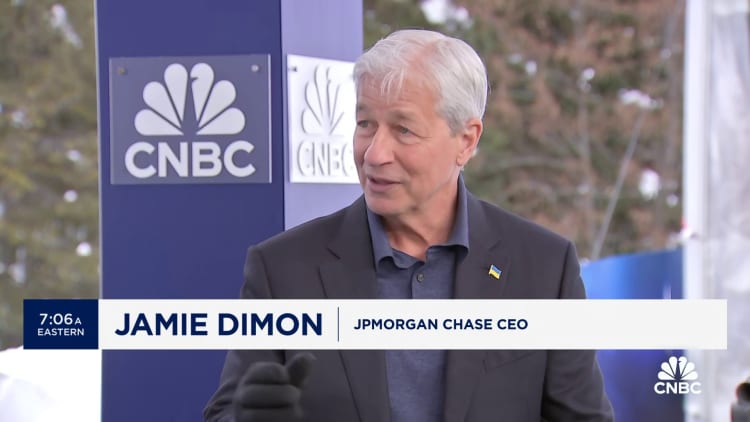

DAVOS, Switzerland — Bitcoin does nothing, JPMorgan Chase CEO Jamie Dimon mentioned Wednesday on the sidelines of the World Financial Discussion board.

“I name it the pet rock,” he added.

Dimon is a long-time bitcoin critic. The financial institution chief mentioned in 2021 at peak crypto valuations that bitcoin was “nugatory,” and he doubled down on that sentiment final yr in Davos when he instructed CNBC that the digital forex was a “hyped-up fraud.”

Bitcoin is buying and selling simply above $42,700, up greater than 100% within the final yr.

“That is the final time I am speaking about this with CNBC, so assist me god,” Dimon mentioned. “Blockchain is actual. It is a know-how. We use it. It should transfer cash, it should transfer knowledge. It is environment friendly. We have been speaking about that for 12 years, too, and it is very small.”

“I feel we waste too many phrases on that,” Dimon added.

The financial institution chief went on to differentiate bitcoin from the opposite class of cryptocurrencies, those by which blockchain has enabled using good contracts. Sensible contracts are a programmable piece of code written on a public blockchain, similar to ethereum, which executes when sure situations are met, negating the necessity for a central middleman.

“There is a cryptocurrency which could really do one thing,” Dimon mentioned of good chain-enriched blockchains. “You need to use it to purchase and promote actual property and transfer knowledge; tokenizing issues that you simply do one thing with.

“After which there’s one which does nothing,” Dimon mentioned of bitcoin, although he added that there have been actual use circumstances for the digital coin, which included upwards of $100 billion a yr caught up in fraud, tax avoidance and intercourse trafficking. “I defend your proper to do bitcoin,” Dimon added, saying, “I do not wish to inform you what to do. So my private recommendation could be do not get entangled… But it surely’s a free nation.”

The world’s largest cryptocurrency, with a market cap of over $830 billion, was cemented as an asset class final week when the SEC authorized the creation of bitcoin exchange-traded funds.

A few of the greatest names in asset administration, together with BlackRock, Franklin Templeton and WisdomTree, have launched their very own spot bitcoin ETFs final week. For the $30 trillion suggested wealth administration business, the floodgates might be about to open. Analysts at Customary Chartered anticipate fund inflows within the vary of $50 billion to $100 billion in 2024.

When requested what he manufactured from Larry Fink altering his view on bitcoin as BlackRock jumped into the spot ETF enterprise, Dimon mentioned, “I do not care. So simply please cease speaking about this s***.”

“I do not know what he would say about blockchain versus currencies that do one thing versus bitcoin that does nothing,” Dimon added. “However you recognize that is what makes a market. Individuals have opinions, and that is the final time I am ever going to state my opinion.”