Mark Zuckerberg, CEO, Meta Platforms, in July 2021.

Kevin Dietsch | Getty Photographs Information | Getty Photographs

Meta will report first-quarter outcomes after the bell Wednesday.

This is what analysts predict.

- Earnings per share: $4.32, in keeping with LSEG.

- Income: $36.16 billion, in keeping with LSEG.

- Day by day energetic customers (DAUs): 2.12 billion, in keeping with StreetAccount

- Month-to-month energetic customers (MAUs): 3.09 billion, in keeping with StreetAccount

- Common income per person (ARPU): $11.75 in keeping with StreetAccount

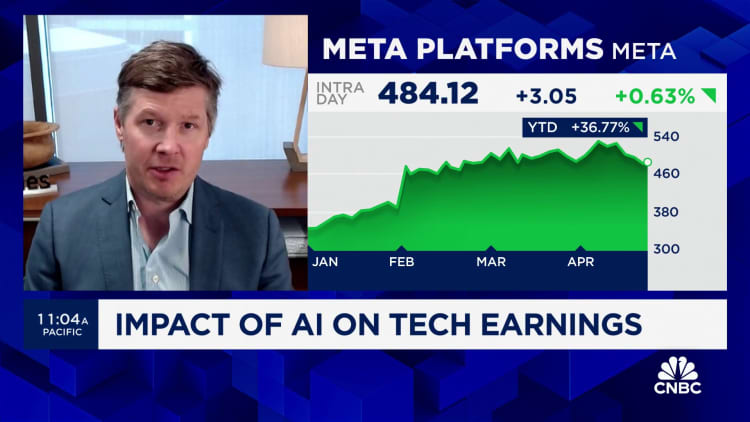

Meta has been a favourite on Wall Road since early 2023, when CEO Mark Zuckerberg instructed traders it might be the “yr of effectivity.” The inventory virtually tripled final yr, trailing solely Nvidia amongst members of the S&P 500, and is up one other 40% in 2024.

The Fb mum or dad has been clawing again digital advert market share after a dismal 2022. At the moment, the corporate was reeling from Apple’s iOS privateness replace and macroeconomic issues that led many manufacturers to rein in spending.

Zuckerberg spearheaded an initiative to rebuild the advert enterprise with a deal with synthetic intelligence. On the corporate’s final earnings name in February, finance chief Susan Li mentioned Meta has been investing in AI fashions that may precisely predict related adverts for customers, in addition to instruments that automate the ads-creation course of.

Analysts anticipate Meta to report a 26% improve in income from $28.65 billion a yr earlier. That will mark the quickest charge of development because the third quarter of 2021, which was earlier than Apple’s privateness change began to point out up on different firms’ steadiness sheets.

Meta is benefiting from a stabilizing financial system and surge in spending from Chinese language low cost retailers like Temu and Shein, which have been pumping cash into Fb and company-owned Instagram in an effort to achieve a wider swath of customers. Analysts at Baird mentioned in a Monday observe that slower spending from China-based advertisers could possibly be a supply of concern within the first-quarter outcomes.

Nonetheless, the Baird analysts see persevering with momentum for Meta, and mentioned they’ve “fairly excessive” expectations for the corporate due to its bettering advertiser instruments and success in short-form video monetization.

Traders will stay centered on Meta’s prices, which have been central to the inventory rally. Early final yr, Zuckerberg mentioned the corporate could be higher at eliminating pointless tasks and cracking down on bloat, which might assist Meta change into a “stronger and extra nimble group.”

The corporate minimize about 21,000 jobs within the first half of 2023, and Zuckerberg mentioned in February of this yr that hiring will likely be “comparatively minimal in comparison with what we might have finished traditionally.”

As of Dec. 31, Meta had a worldwide workforce of 67,317, down from a peak of greater than 87,000 workers in 2022, in keeping with Securities and Alternate Fee filings.

Jefferies analysts wrote in a report final week that it is “exhausting to argue with excellence.” The analysts anticipate Meta to beat on its first-quarter outcomes and supply better-than-expected steering for the second quarter. As of now, the typical analyst estimate requires income development of 20% within the second quarter to $38.29 billion, in keeping with LSEG.

“We proceed to be inspired by META’s potential to maintain double-digit rev development, given the mix of upper engagement from AI investments, and rising advertiser ROI & effectivity,” the Jefferies analysts wrote.

Meta’s Actuality Labs unit, which homes the corporate’s {hardware} and software program for growth of the nascent metaverse, continues to bleed money. Analysts anticipate the division to point out an working lack of $4.31 billion for the quarter, on prime of the $42 billion it is misplaced because the finish of 2020. Income within the unit is projected to achieve $512.5 million, a 51% improve from $339 million a yr earlier.

Executives will focus on the corporate’s outcomes on a name with analysts at 5 p.m. ET.