A Fb signal is seen on the second China Worldwide Import Expo (CIIE) in Shanghai, China November 6, 2019.

Aly Music | Reuters

Meta could also be banned from working in China, however the firm is discovering loads of development coming from the world’s second-biggest financial system.

In its third-quarter earnings report on Wednesday, Meta stated gross sales rose 23% from a 12 months earlier, illustrating the corporate’s means to climate a tricky digital advert market higher than smaller rivals like Snap and X, previously referred to as Twitter.

Susan Li, Meta’s finance chief, advised analysts on the earnings name that Chinese language corporations performed a serious position this quarter, persevering with a theme from latest durations.

On-line commerce and gaming “benefited from spend amongst advertisers in China reaching prospects in different markets,” Li stated. Meaning Chinese language corporations are spending large cash on Meta’s platforms like Fb and Instagram to ship focused promoting to the corporate’s billions of customers world wide.

Amongst Meta’s geographic areas, Li stated the remainder of the world class confirmed the strongest development, at 36%. Europe was subsequent at 35%, adopted by Asia-Pacific at 19% and North America at 17%. The primary class contains South America, and Li stated China was an enormous motive for the speedy enlargement.

“Brazil was a robust contributor to the area’s acceleration due partly to elevated advertisers demand from China advertisers focusing on customers in Brazil,” Li stated.

Fb, together with Google and Twitter, are all blocked in China because of the nation’s Nice Firewall. Fb and its sibling apps have been inaccessible there since 2009.

Nonetheless, Meta has witnessed a “longer-term pattern of total development” from the China market, Li stated, although there have been some “durations of volatility.” As an example, she stated that the previous two years have been marred by greater delivery prices that resulted from the Covid pandemic, which additionally introduced strict lockdown guidelines in China.

However with China opening up extra this 12 months and the worldwide provide chain issues easing, Chinese language corporations wish to increase their companies across the globe and are utilizing Meta as a serious instrument.

In the end, “spending from Chinese language advertisers additional accelerated for us in Q3,” Li stated, including that “decrease delivery prices and easing laws on the gaming business have served as tailwinds right here.”

Li careworn “the potential for volatility sooner or later” notably as a result of “there are such a lot of macro elements at play which can be fairly exhausting to foretell.”

Particularly, Li cited the unpredictability within the Center East because of the Israel-Hamas warfare, which led Meta to widen its income steerage vary.

“We have now noticed softer advertisements at first of the fourth quarter, correlating with the beginning of the battle, which is captured in our This autumn income outlook,” Li stated. “It is exhausting for us to attribute demand softness on to any particular geopolitical occasion.”

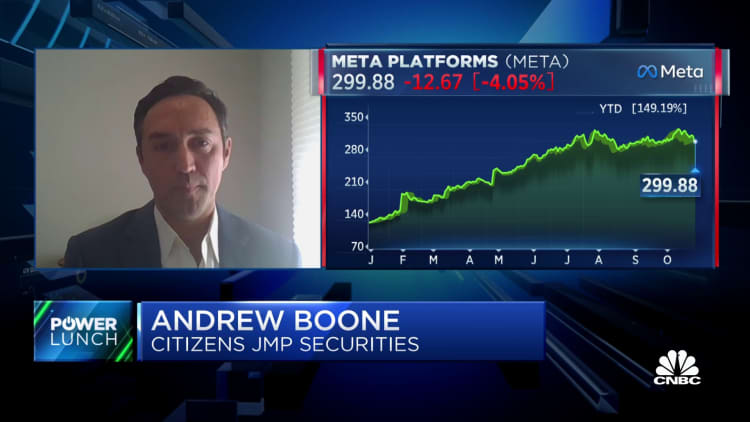

Meta shares dropped greater than 3% in prolonged buying and selling, wiping out earlier good points, after Li’s cautionary feedback.

Watch: Large tech earnings, AI utilization and development beneath scrutiny