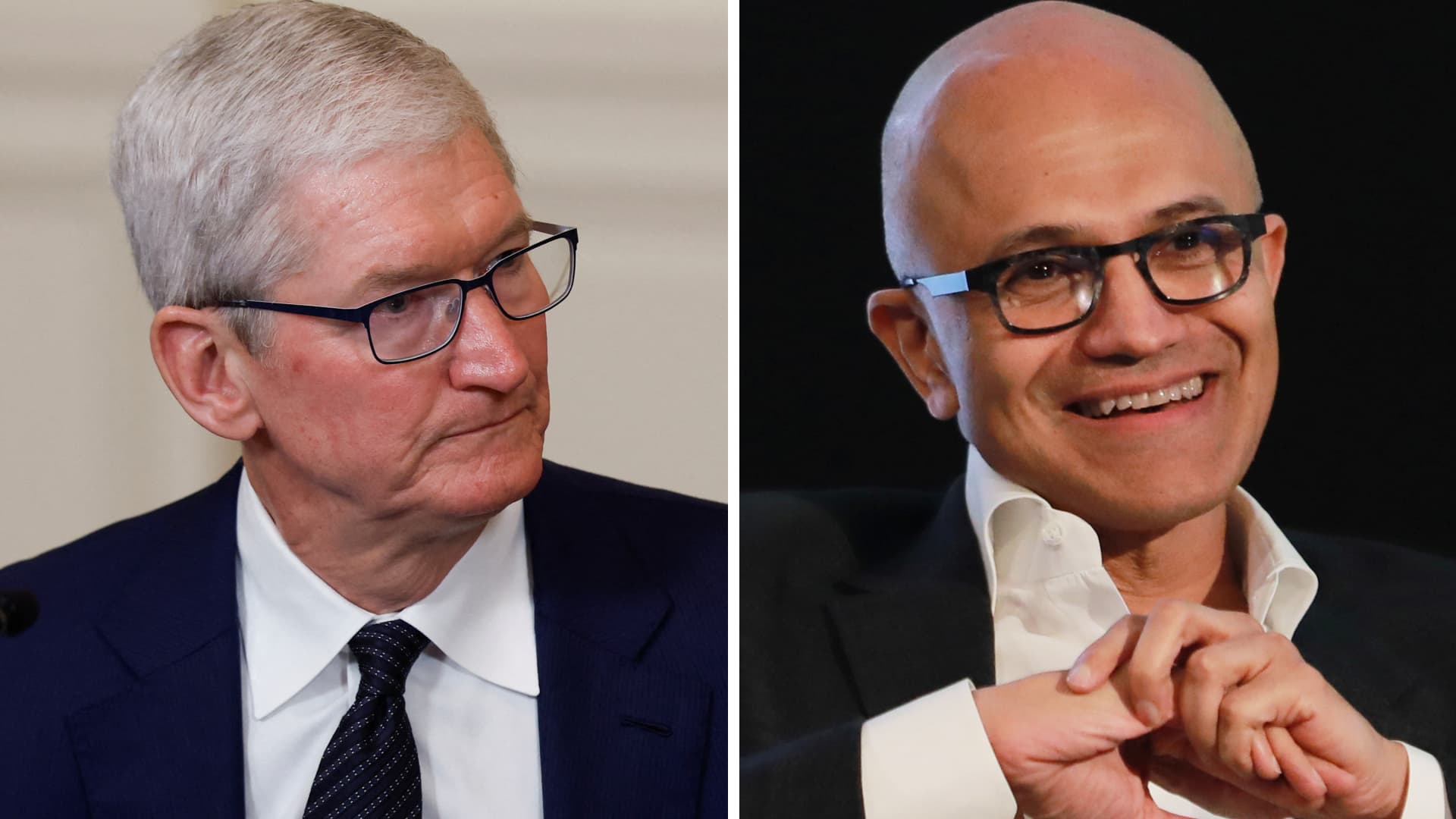

Apple CEO Tim Prepare dinner, left, and Microsoft CEO Satya Nadella.

Reuters

Microsoft ended Friday’s U.S. buying and selling session as probably the most helpful publicly traded firm, surpassing Apple after briefly topping the iPhone maker throughout intraday buying and selling on Thursday.

Shares of Microsoft climbed greater than 3% for the week, bringing the corporate’s market cap to $2.89 trillion, whereas Apple’s inventory dropped by over 3%, reducing its valuation to $2.87 trillion.

Redburn Atlantic Equities analyst James Cordwell downgraded Apple to impartial from purchase on Wednesday, citing “little room for upside over the brand new few years” in iPhone progress and an “anticipated underwhelming March quarter.”

Apple stated on Thursday that former Vice President Al Gore will retire from the corporate’s board subsequent month after serving as a director since 2003.

Microsoft, in the meantime, bought a vote of confidence on Thursday after discussing its synthetic intelligence capabilities to builders at an occasion in San Francisco. Piper Sandler analysts advised purchasers in a word that they had been “inspired by the momentum round probably the most mature AI merchandise” and talked about that GitHub web site site visitors has accelerated 12 months over 12 months for 3 months in a row. The analysts have the equal of a purchase score on Microsoft shares.

Apple had been probably the most helpful public firm for over a 12 months, following transient intervals when that distinction was held by Saudi Aramco and Microsoft.

WATCH: The AI darkish horse