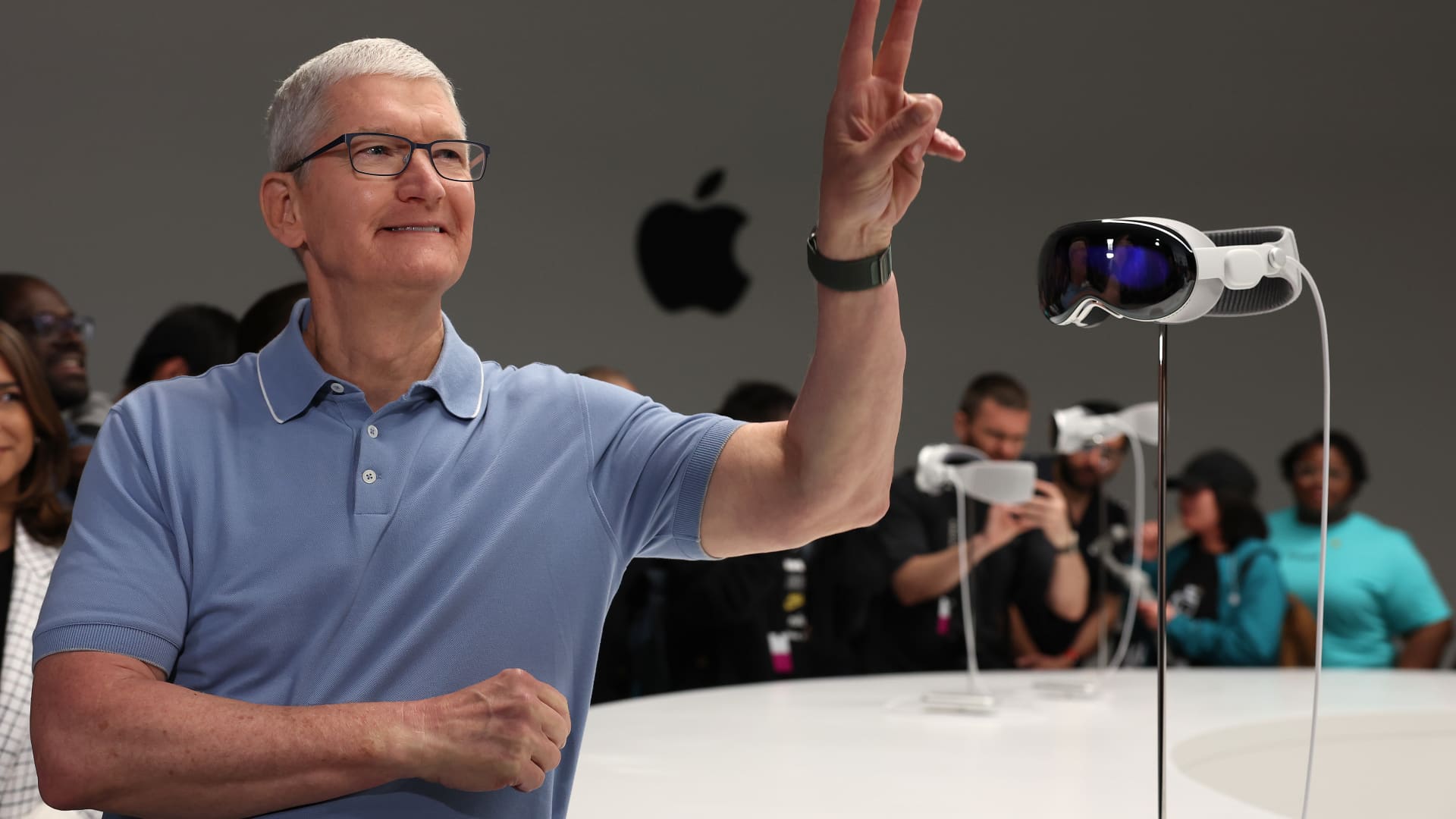

Apple CEO Tim Prepare dinner stands subsequent to the brand new Apple Imaginative and prescient Professional headset is displayed in the course of the Apple Worldwide Builders Convention on June 05, 2023 in Cupertino, California.

Justin Sullivan | Getty Photographs

The final time know-how shares had a greater first half, Apple was touting its Lisa desktop laptop, IBM was the most-valuable tech firm within the U.S. and Mark Zuckerberg hadn’t been born.

On Friday, the Nasdaq wrapped up the primary six months of the yr with a 1.5% rally, bringing its positive factors up to now for 2023 to 32%. That is the sharpest first-half soar within the tech-heavy index since 1983, when the Nasdaq rose 37%.

It is a startling achievement, given what’s occurred within the tech trade over the previous 4 a long time. Microsoft went public in 1986, sparking a PC software program growth. Then got here the web browsers of the Nineties, main as much as the dot-com bubble years and the hovering costs of e-commerce, search and computer-networking shares. The previous decade noticed the emergence of the mega-cap, trillion-dollar firms, which are actually essentially the most precious enterprises within the U.S.

Whereas these prior eras featured sustained rallies, none of them had a begin to the yr rivaling 2023.

Much more beautiful, it is taking place this yr whereas the U.S. economic system remains to be prone to slipping into recession and reckoning with a banking disaster, highlighted by the collapse in March of Silicon Valley Financial institution, the monetary nucleus for a lot of the enterprise and startup world. The Federal Reserve additionally steadily elevated its benchmark rate of interest to the best since 2007.

However momentum is at all times a driver with regards to tech, and buyers are notoriously afraid of lacking out, even when they concurrently fear about frothy valuations.

Coming off a depressing 2022, by which the Nasdaq misplaced one-third of its worth, the large story was cost-cutting and effectivity. Mass layoffs at Alphabet, Meta and Amazon in addition to at quite a few smaller firms paved the best way for a rebound in earnings and a extra life like outlook for progress.

Meta and Tesla, which each received hammered final yr, have greater than doubled in worth up to now in 2023. Alphabet is up 36% after dropping 39% in 2022.

None of these firms have been across the final time the Nasdaq had a greater begin to the yr. Meta CEO Zuckerberg, who created the corporate previously often known as Fb in 2004, was born in 1984. Tesla was based in 2003, 5 years after Google, the predecessor to Alphabet.

As 2023 received going, consideration turned to synthetic intelligence and a flood of exercise round generative AI chatbots, which reply to text-based queries with clever and conversational responses. Microsoft-backed OpenAI has develop into a family identify (and was No. 1 on CNBC’s Disruptor 50 record) with its ChatGPT program, and {dollars} are pouring into Nvidia, whose chips are used to energy AI workloads at most of the firms benefiting from the newest developments.

Nvidia shares soared 190% within the first half, lifting the 30-year-old firm’s market cap previous $1 trillion.

“I believe you are going to proceed to see tech dominate as a result of we’re nonetheless all abuzz about AI,” mentioned Bryn Talkington, managing companion at Requisite Capital Administration, in an interview with CNBC’s “Closing Bell” on Thursday.

Talkington, whose agency holds Nvidia shares, mentioned the chipmaker has a singular story, and that its progress isn’t shared throughout the trade. Quite, giant firms engaged on AI must spend closely on Nvidia’s know-how.

“Nvidia not solely owns the shovels and axes of this AI goldrush,” Talkington mentioned. “They really are the one ironmongery store on the town.”

Keep in mind the $10,000 Lisa?

Apple hasn’t seen positive factors fairly so dramatic, however the inventory remains to be up 50% this yr, buying and selling at a file and pushing the iPhone maker to a $3 trillion market cap.

Apple nonetheless counts on the iPhone for the majority of its income, however its newest soar into digital actuality with the announcement this month of the Imaginative and prescient Professional headset has helped reinvigorate investor enthusiasm. It was Apple’s first main product launch since 2014, and shall be out there beginning at $3,499 starting early subsequent yr.

That seems like so much, besides when in comparison with the value tag for the preliminary Lisa laptop, which Apple rolled out 40 years in the past. That PC, named after co-founder Steve Jobs’ daughter, began at $10,000, retaining it far out of the arms of mainstream shoppers.

Apple’s income in 1983 was roughly $1 billion, or concerning the amount of cash the corporate introduced in on a mean day within the first quarter of 2023 (Apple’s fiscal second quarter).

Tech was the clear story for the fairness markets within the first half, because the broader S&P 500 notched a 16% achieve and the Dow Jones Industrial Common rose simply 2.9%.

Traders on the lookout for purple flags heading into the second half do not must look far.

World financial considerations persist, highlighted by uncertainty surrounding the conflict in Russia and Ukraine and ongoing commerce tensions with China. Quick-term rates of interest are actually above 5%, which means buyers can get risk-free returns within the mid-single digits from certificates of deposit and high-yield financial savings accounts.

One other signal of skepticism is the absence of a tech IPO market, as rising firms proceed to sit down on the sidelines regardless of brewing enthusiasm throughout the trade. There hasn’t been a notable enterprise capital-backed tech IPO within the U.S. since late 2021, and buyers and bankers inform CNBC that the second half of the yr is poised to stay quiet, as firms watch for higher predictability of their numbers.

Jim Tierney, chief funding officer of U.S. concentrated progress at AllianceBernstein, informed CNBC’s “Energy Lunch” on Friday that there are many challenges for buyers to think about. Like Talkington, he is uncertain how a lot of a lift the broader company world is seeing from AI in the intervening time.

“Attending to AI particularly, I believe we’ve to see profit for all firms,” Tierney mentioned. “That may come, I am simply unsure that is going to occur within the second half of this yr.”

In the meantime, financial information is blended. A survey earlier this month from CNBC and Morning Seek the advice of discovered that 92% of People are chopping again on spending as inflationary pressures persist.

“The basics get more durable,” Tierney mentioned. “You take a look at client spending as we speak, the buyer is pulling again. All of that means that the basics are extra stretched right here than not.”

WATCH: CNBC’s full interview with Ron Insana and Jim Tierney