Hon Hai Group’s headquarters, in Taipei, Taiwan, 15 July 2021.

Ceng Shou Yi | Nurphoto | Getty Photographs

Apple iPhone provider Foxconn, formally generally known as Hon Hai, on Tuesday reported third-quarter revenue rose 11.27% from a 12 months in the past, beating analysts’ expectations regardless of an ongoing shopper electronics stoop.

Listed here are Foxconn’s outcomes for the quarter ended September versus LSEG consensus estimates:

- Income: $1.543 trillion New Taiwan {dollars} ($47.71 billion), vs. NT$1.559 trillion anticipated

- Web earnings: NT$43.12 billion, vs. NT$35.078 billion anticipated

The Taiwanese agency reported working income slipped 11.64% from a 12 months in the past to NT$1.543 trillion, whereas web earnings elevated 11.27% from a 12 months in the past to NT$43.13 billion, beating analysts’ expectations. Foxconn reported a NT$38.75 billion web revenue in the identical interval a 12 months in the past.

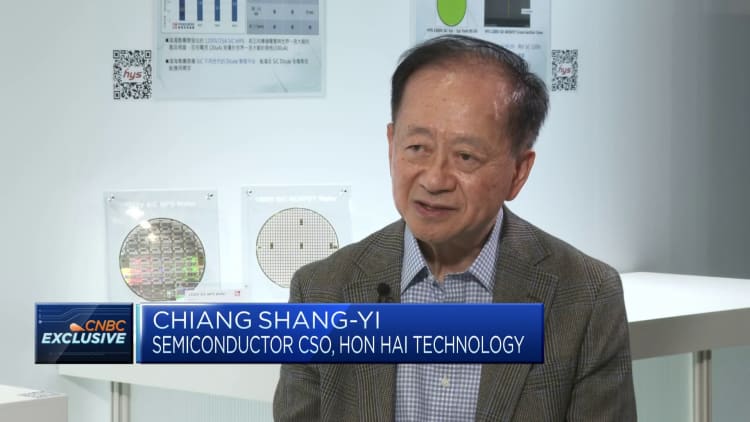

The world’s largest contract electronics maker, Hon Hai Expertise Group, assembles shopper merchandise like Apple’s iPhones.

Knowledge compiled by Counterpoint Analysis revealed that international smartphone sell-through volumes within the third quarter grew 2% quarter-on-quarter, regardless of falling 8% year-on-year – its lowest third quarter ranges in a decade and the ninth consecutive quarter to document a decline.

A sell-through refers to when a shopper buys a very good instantly from a retailer.

“Volumes declined year-on-year largely resulting from slower than anticipated restoration in shopper demand. However the market’s quarter-on-quarter development, particularly the constructive efficiency in September regardless of one full week much less of gross sales of the new iPhones, is probably going an indication of constructive information forward,” stated Counterpoint Analysis in a report on Oct. 17. Apple’s iPhone 15 sequence was launched on Sept. 22.

Analysis agency Canalys stated final week that the worldwide smartphone market is seeing a slowdown in its decline. The market noticed only a 1% drop within the third quarter 2023, in response to Canalys information.

“Bolstered by regional recoveries and new product improve demand, the smartphone market recorded a double-digit sequential development in third quarter, forward of the gross sales seasons,” stated Canalys on Oct. 17.

“Huawei and Apple’s new launches electrified the market this quarter, outshining many different distributors’ flagship sequence renewals,” stated Amber Liu, analyst at Canalys, including that Huawei’s newest smartphone Mate 60 Professional which was launched in September is drawing “enthusiastic” demand in Mainland China.

“In the meantime, Apple is bolstering its new iPhone 15 sequence with much-enhanced efficiency and options to constantly stimulate demand,” stated Liu.

The continued electronics stoop has badly impacted the worldwide smartphone market.

Demand for digital items reminiscent of smartphones has slowed dramatically with international macro uncertainties. Amid rising inflation charges, shoppers have been reducing again on purchases of shopper units.

Foxconn stated in its earnings report that it expects financial insurance policies, inflation, geopolitics and macroeconomics to have an effect on its enterprise in 2024.

In August, the federal government of Indian state of Karnataka stated Foxconn will make investments greater than $600 million to construct a cellphone manufacturing mission and a separate semiconductor gear facility.

India may account for 20% to 30% of Hon Hai’s manufacturing, which is “similar to China,” chairman and CEO Younger Liu informed CNBC final month.

In October, Chinese language state media World Occasions reported, citing unnamed sources, that a number of workplaces of Hon Hai’s subsidiaries throughout China had been subjected to tax audits and on-site investigations into land use.