The manufacturing of a brand new Beatles music utilizing synthetic intelligence reveals the expertise presents alternatives, not simply dangers, for firms like Common Music Group NV, in line with Citigroup Inc. analysts.

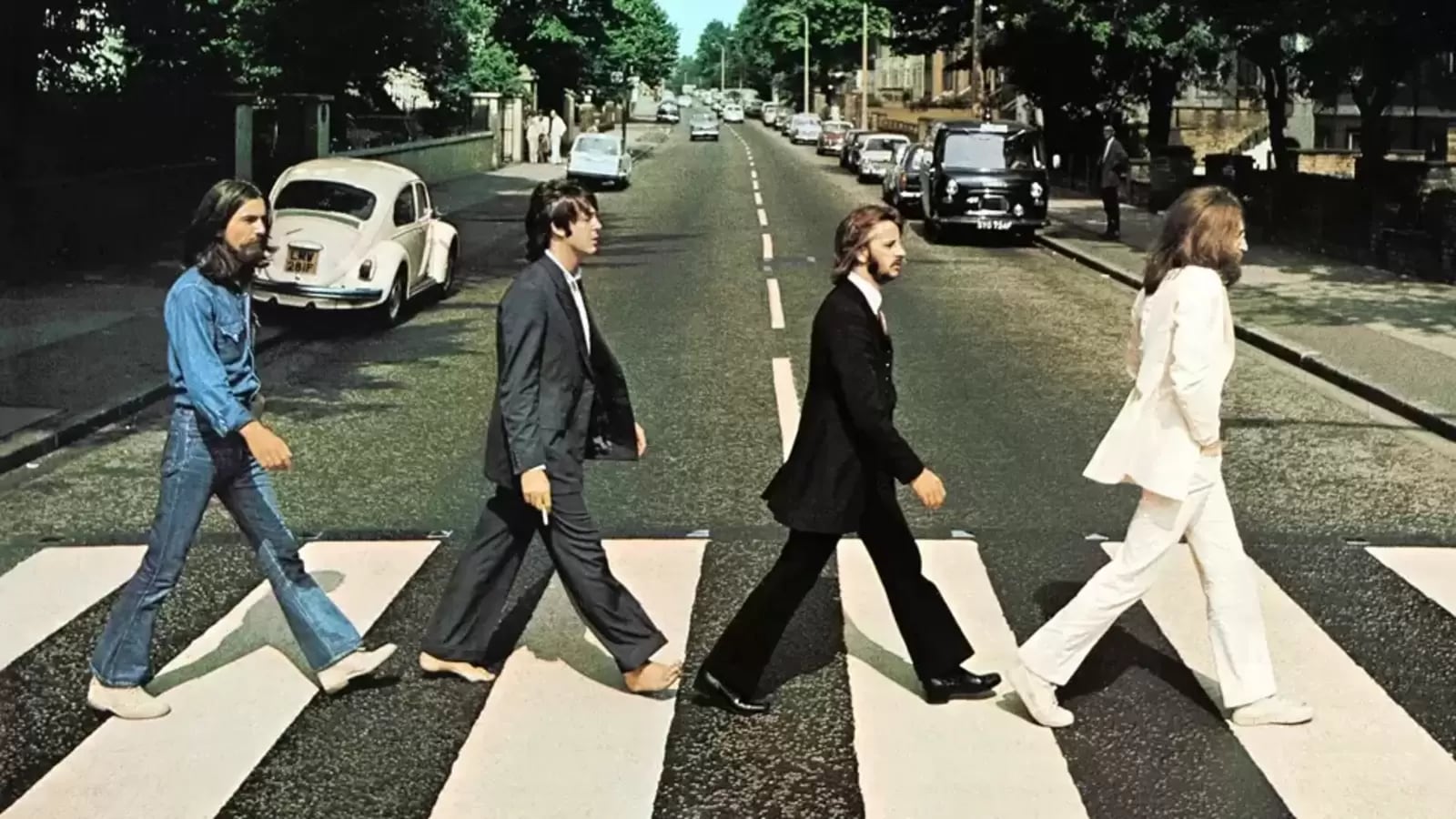

Singer Paul McCartney instructed the BBC this week that AI had been used to “extricate” John Lennon’s voice from an outdated demo so he may full a “remaining” Beatles music. The event suggests report firms will be capable of mine historic grasp recordings for brand spanking new content material, analyst Thomas A Singlehurst wrote in a observe to purchasers.

The instruments “will probably be useful for the legacy recorded music firms when it comes to letting them ‘sweat’ historic belongings tougher,” he added.

Citi expects the risk-reward from AI to be “pretty balanced,” and holds a impartial ranking on UMG. Bloomberg Information has reached out to UMG for remark.

AI-generated music has been criticized by some members of the business, who say artists and rights homeowners could also be denied compensation if bots use their songs to provide content material. Common, the report label for Taylor Swift and The Weeknd, has stated the coaching of generative AI utilizing its artists’ music represents a breach of its agreements and a violation of copyright regulation.

Earlier this 12 months, a music referred to as ‘Coronary heart on My Sleeve,’ created by an unknown TikTok consumer with AI-generated vocals from Drake and The Weeknd went viral after being uploaded on streaming providers. Nation singer-songwriter Chris Stapleton has referred to as on legislators to stop AI from impersonating music artists.

However whereas AI dangers rising the amount of music accessible to customers, the Beatles improvement provides one other dimension to the dialogue, in line with Citi’s Singlehurst.

“It highlights that the controversy round danger/alternative from AI for music is extra nuanced than maybe the ‘Loser vs. Winner’ basket debate might counsel,” he added.

UMG shares have been down 0.2% to €20.04 as of 1:57 p.m. in Amsterdam. Citigroup’s worth goal of €23.50 implies a 17% upside to the inventory from present ranges.