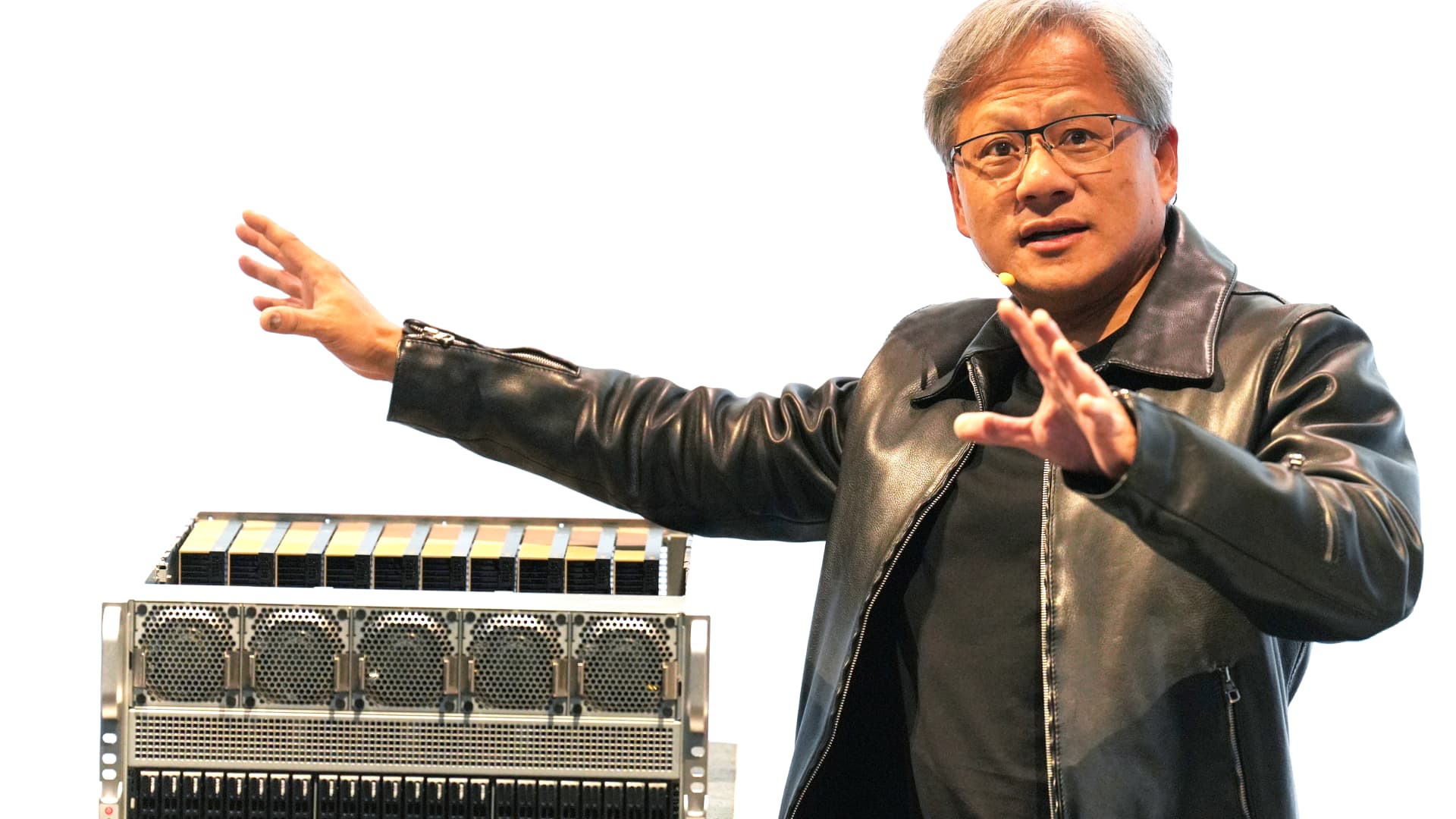

Nvidia CEO Jensen Huang,speaks on the Supermicro keynote presentation through the Computex convention in Taipei on June 1, 2023.

Walid Berrazeg | Sopa Pictures | Lightrocket | Getty Pictures

Nvidia is ready to report fiscal second-quarter earnings after market shut Wednesday. The chipmaker’s inventory worth has greater than tripled this 12 months, sparked by a increase in synthetic intelligence purposes.

This is what analysts expect:

- Earnings: $2.09 per share, based on Refinitiv.

- Income: $11.22 billion, based on Refinitiv.

This is what Wall Avenue is anticipating from Nvidia’s prime enterprise items:

- Gaming: $2.38 billion in income, based on StreetAccount

- Datacenter: $8.03 billion in income, based on StreetAccount

Pushed by insatiable demand for graphics processing items (GPUs), that are on the coronary heart of most generative AI companies, Nvidia’s income doubtless elevated 67% within the quarter ended July 31, from $6.7 billion a 12 months earlier.

Buyers shall be significantly centered on Nvidia’s outlook to see if the momentum is poised to proceed. Analysts count on third-quarter income of $12.61 billion, based on Refinitiv, which might be a rise of over 110% from the prior 12 months.

Nvidia CEO Jensen Huang has positioned his firm on the heart of the AI wave, and stated just lately it was seeing “surging demand.” He in contrast final 12 months’s launch of OpenAI’s ChatGPT chatbot to the introduction of the iPhone in 2007. Nvidia is the first vendor of GPUs wanted to coach and run AI fashions like ChatGPT.

The inventory has been by far the most effective performer this 12 months within the S&P 500, which is up about 16% in 2023. Fb guardian Meta is subsequent in line, up 146%.

However Nvidia’s hovering inventory worth means that the corporate is strolling a tightrope. It wants to point out unimaginable progress in each income and earnings to justify its $1 trillion-plus valuation and a revenue a number of that dwarfs richly valued firms like Tesla and Amazon.

A more in-depth take a look at estimates reveals simply how reliant Nvidia has turn out to be on AI chips. Gaming, the corporate’s traditionally core enterprise, is not thriving in almost the identical manner.

Nvidia is anticipated to put up $2.38 billion in gaming income through the quarter, which might be a 16% enhance from a 12 months earlier. However that is a simple comparability to 2022 numbers, which mirrored a deep droop in graphics playing cards as a result of so many individuals refreshed their gaming expertise through the pandemic. It additionally consists of gross sales from the chip on the coronary heart of Nintendo’s Change.

In contrast, Nvidia’s Datacenter group, which homes AI chips, is taking a look at a 111% enhance in income to $8.03 billion, based on estimates. Nvidia’s AI chips, together with the A100 and H100, have been troublesome to buy in current months as startups, large firms, governments and cloud suppliers all place their orders on the identical time.

Nvidia faces some challenges that administration would possibly deal with on the decision. Provide is a matter, on condition that Taiwan Semiconductor Manufacturing Firm (TSMC) manufactures the chips Nvidia designs. Huang had dinner with TSMC chairman Morris Chang through the quarter.

China is one other large subject. Final 12 months, the U.S. positioned export restrictions on Nvidia, which compelled the corporate to make specialised, slower variations of its AI chips for the Chinese language market. Further export restrictions presently being thought of by the Biden administration may additional restrict the merchandise Nvidia sells to Chinese language firms.

WATCH: Nvidia earnings may transfer index away from seasonally weak interval