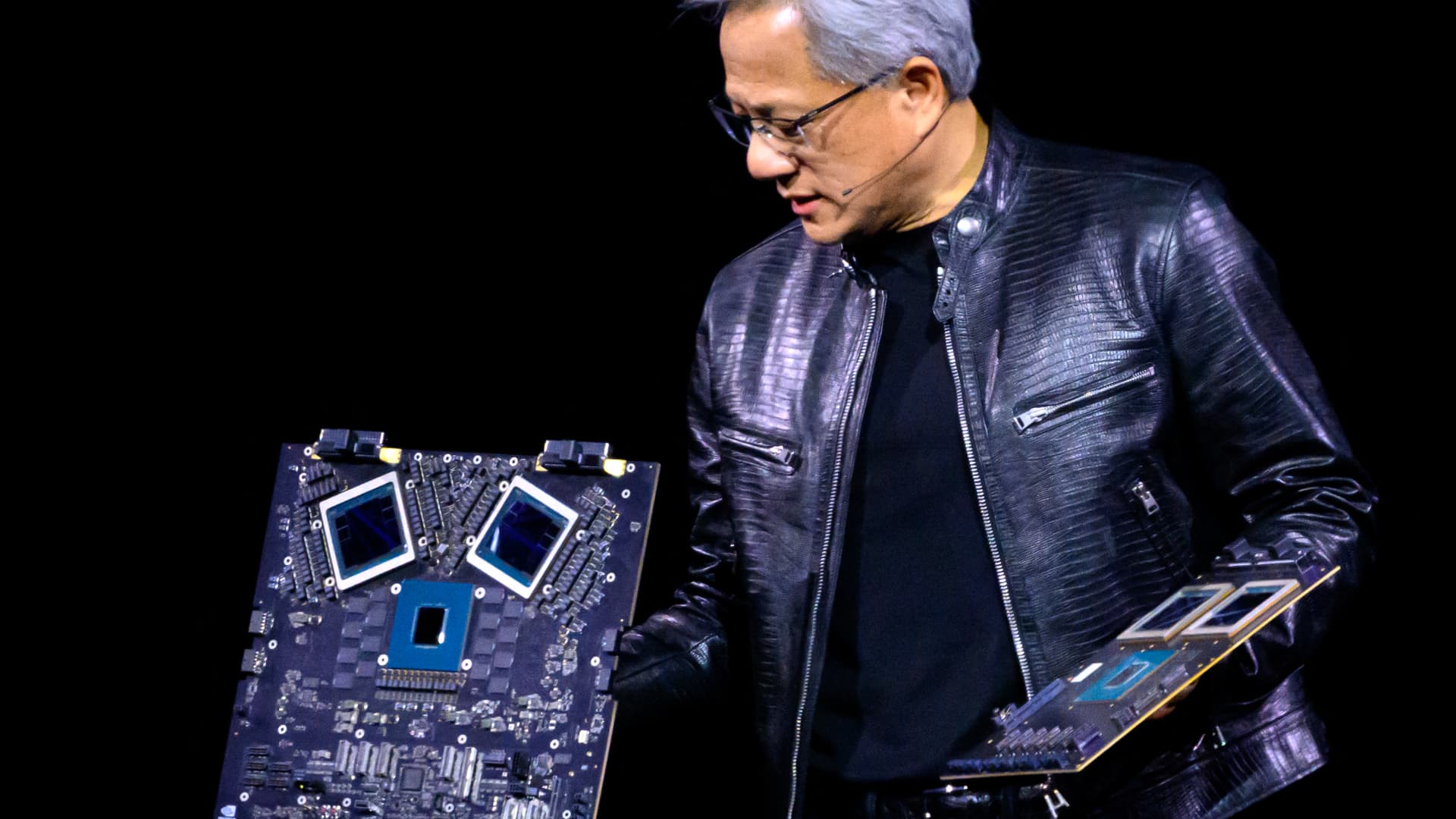

Nvidia founder and CEO Jensen Huang shows merchandise onstage in the course of the annual Nvidia GTC Convention on the SAP Heart in San Jose, California, on March 18, 2024.

Josh Edelson | Afp | Getty Photos

Chipmaking large Nvidia has entered “correction territory,” with shares now down 10% from all-time highs.

The corporate, which makes graphics processing models — or GPUs — has been a key beneficiary of the synthetic intelligence increase, which boosted demand for its chips.

Nvidia GPUs are generally used for compute-intensive AI purposes, similar to OpenAI’s ChatGPT AI chatbot. Its server chips are additionally a key element of knowledge facilities.

The corporate’s monetary efficiency has been on a tear previously yr. It reported a 486% leap in non-GAAP earnings per diluted share within the December quarter, citing large chips demand, because of the recognition of generative AI fashions.

The inventory has come underneath stress for the previous two weeks, nonetheless. Shares are off 10% from their final all-time excessive shut of $950 apiece, which they hit on March 25. The inventory closed at a value of $853.54 on Tuesday, down 2% for the session.

Shares are down 1% in U.S. premarket buying and selling.

Definitions on what constitutes a market correction differ, however it’s typically thought of to be a sustained drop of 10% or extra from all-time highs.

What is the purpose for the transfer?

The precise purpose for the downward transfer hasn’t been instantly clear. Buyers may very well be taking revenue on the inventory, after a wild achieve of over 200% for the shares within the final 12 months. And on Tuesday, rival chipmaker Intel unveiled a brand new AI chip referred to as Gaudi 3, geared toward powering massive language fashions — the cornerstone expertise behind generative AI instruments like OpenAI’s ChatGPT.

Intel stated the brand new chip is over twice as power-efficient as Nvidia’s H100 GPU — the U.S. chip large’s most superior graphics card — and might run AI fashions one-and-a-half instances quicker than this tech.

Analysts at D.A. Davidson stated in a analysis word that they anticipate a “shrinking” of the dimensions of AI fashions, together with options like Mistral’s Giant and Meta’s LLaMA mannequin, to drive down demand for Nvidia’s inventory over time.

“Though NVDA (Impartial-rated) ought to ship a spectacular 2024 (and maybe into 2025), we proceed to imagine current traits arrange a big cyclical downturn by 2026,” D.A. Davidson analysts stated within the 9 word Tuesday.

“A mix of shrinking fashions, extra regular development in demand, maturing hyperscaler investments, and elevated reliance by their largest prospects on their very own chips don’t bode nicely for NVDA’s out years.”

– CNBC’s Ganesh Rao contributed to this report