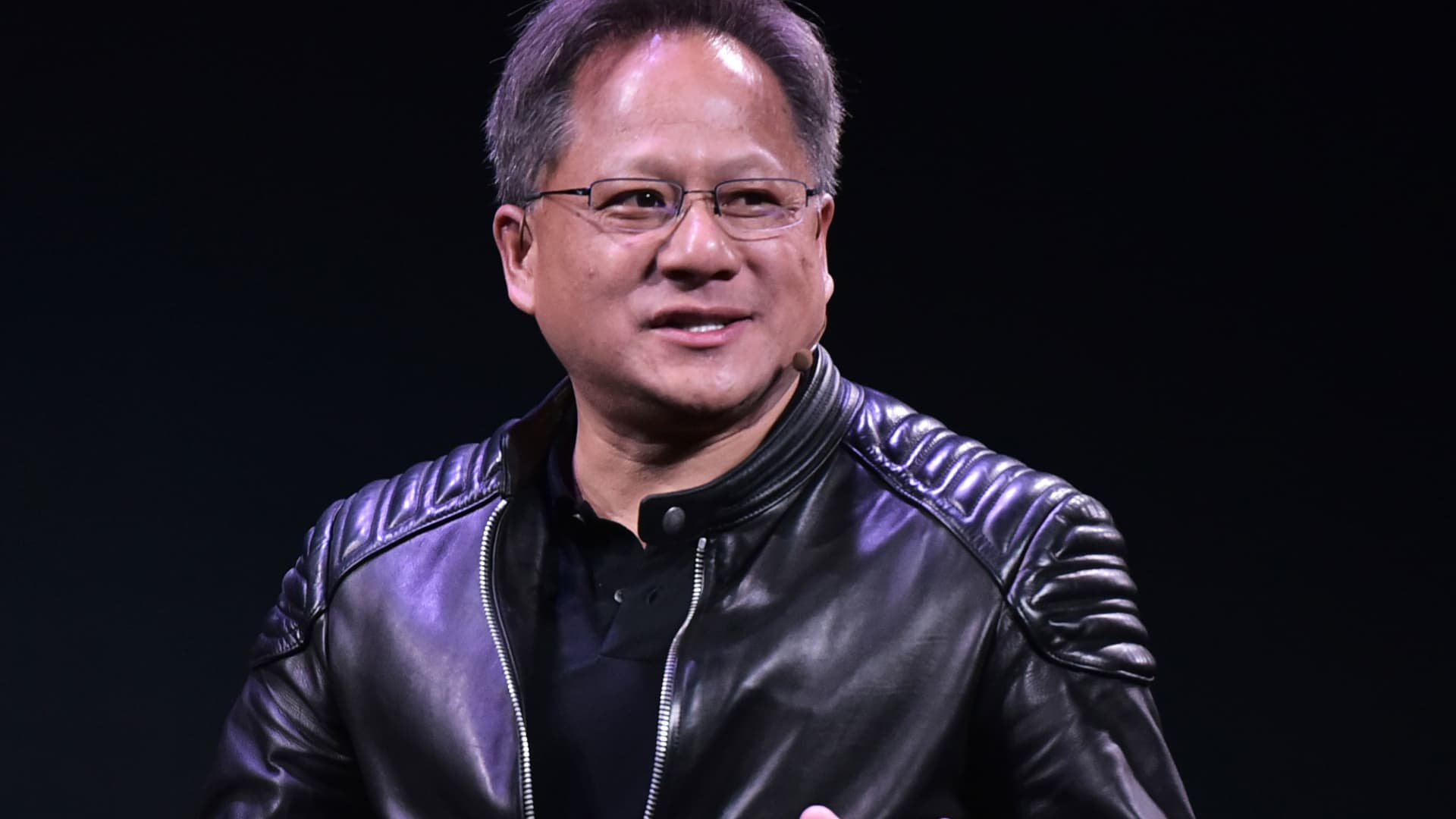

Nvidia CEO Jensen Huang speaks throughout a press convention at The MGM throughout CES 2018 in Las Vegas on January 7, 2018.

Mandel Ngan | AFP | Getty Pictures

Shares of chipmaker Nvidia rose 7% in pre-market buying and selling Thursday, after the corporate reported a beat on the highest and backside traces and supplied robust steerage for the upcoming quarter.

Nvidia reported adjusted earnings per share of $2.70 for the fiscal second quarter, beating a Refinitiv consensus estimate of $2.09. The corporate additionally reported quarterly income of $13.51 billion, versus a consensus estimate of $11.22 billion.

Analysts additionally honed in on robust steerage for the upcoming quarter. The corporate expects round $16 billion of income for its fiscal third quarter, up 170% in comparison with the year-ago interval.

JPMorgan’s Harlan Sur elevated his value goal from $500 to $600 and reiterated an Chubby score on the inventory.

“Expectations have been excessive coming into the print and the staff managed to ship outcomes/outlook that have been well-above purchase aspect expectations pushed by the huge demand pull for its datacenter merchandise,” Sur wrote in a Thursday be aware to purchasers.

Nvidia shares have loved a virtually uninterrupted run this 12 months.

Nvidia inventory is ready to open at a contemporary 52-week excessive, having elevated greater than 220% year-to-date. The corporate has additionally been sitting comfortably within the $1 trillion market cap membership for the previous few weeks.

Heightened, AI-driven demand for Nvidia chips has been a boon for the chipmaker, which has traditionally centered on graphics processing items, or GPUs. As firms throughout industries transfer to construct out their AI chops, there has by no means been extra demand for Nvidia chips.

The corporate expects that heightened demand shall be sustained via 2024.

-CNBC’s Kif Leswing contributed reporting.