Reddit CEO Steve Huffman hugs mascot Snoo as Reddit begins buying and selling on the New York Inventory Change (NYSE) in New York on March 21, 2024.

Timothy A. Clary | AFP | Getty Photographs

Reddit shares have been up 30% to $59.80 on the market’s shut on Monday.

The social media firm’s inventory has been rising ever because it went public final week and raised roughly $750 million from the IPO, of which the corporate logged about $519 million.

Reddit shares soared 48% when it started buying and selling on the New York Inventory Change beneath the inventory ticker “RDDT,” leading to plenty of moderators and customers, generally known as Redditors, incomes hundreds of thousands of {dollars} as a bunch. These Redditers, together with company insiders and their family and friends members, have been capable of partake in Reddit’s IPO by way of a directed-share program, akin to related choices by tech corporations like Airbnb, Rivian and Doximity.

OpenAI CEO Sam Altman, who was a Reddit investor and a former board member, noticed his stake within the firm develop from $200 million to over $613 million by way of the IPO.

Reddit’s IPO got here the identical week that Astera Labs shares skyrocketed 72% on the day that the information heart {hardware} firm made its public market debut on the Nasdaq. Reddit was the primary main social media firm to have gone public since Pinterest’s IPO in 2019, and buyers have been monitoring its inventory debut to gauge whether or not the IPO market would possibly decide up after a protracted lull because of elements like excessive inflation, poor market responses to a number of 2023 IPOs and issues over the broader world financial system.

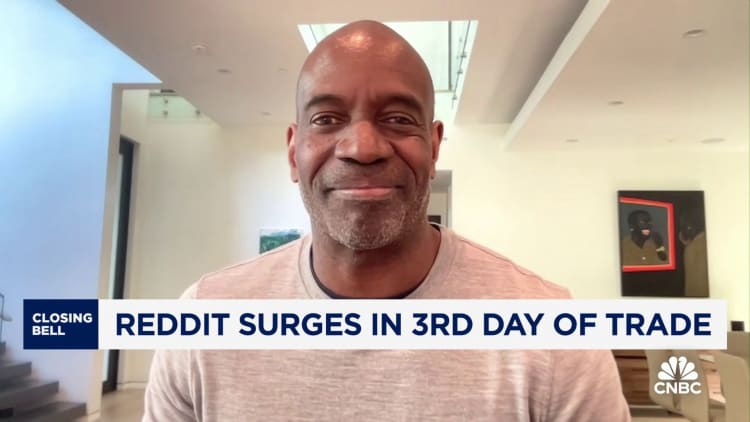

Plexo Capital founding managing associate and Reddit shareholder Lo Toney instructed CNBC that Reddit’s IPO was “a optimistic signal not just for Reddit, however I believe additionally the tech trade and what it would imply for future IPOs.”

“One factor we all know with certainty is that there are lots of investor urge for food through the roadshow for Reddit and we see that it is persevering with to carry up properly,” Toney mentioned. “Clearly the market is signaling there’s an urge for food for extra corporations to return to the general public markets.”

Nonetheless, Toney mentioned that there are different “dynamics that have to occur,” together with a number of extra corporations coming into the general public market earlier than it is protected to say that the IPO floodgates have opened. Toney famous that some startups have raised some huge cash in order that they might not be in any hurry to go public and lift extra cash.

“On the identical time there are situations the place the final non-public market financing could also be increased than what the general public market will settle for as a public firm valuation,” Toney mentioned, including that some startups with excessive non-public valuations should still have issues about going public at a decrease valuation.

Reddit had a non-public market valuation of $10 billion in 2021 when it final raised a funding spherical, in accordance with deal-tracking service Pitchbook, and was valued at roughly $6.5 billion based mostly on its IPO value of $34 per share.

Watch: IPO window opening stays to be seen regardless of sturdy Reddit IPO.