Individuals utilizing their cellphones on July 17, 2016 in Surakarta, Indonesia.

Solo Imaji | Barcroft Media | Getty Photographs

Smartphone shipments in Southeast Asia continued a resurgence in the beginning of 2024, contrasting to a lull in different areas, because the promising marketplace for cell makers continues to draw extra manufacturers and funding.

The highest 5 markets within the area noticed 7.26 million smartphone models shipped, marking a major 20% improve from the identical interval final yr, based on analysis from know-how market analyst agency Canalys revealed Wednesday.

The outcomes proceed a market rebound that started within the fourth quarter of 2023 when Southeast Asia cellphone shipments elevated year-over-year for the primary quarter in nearly two years amid a broader post-pandemic business restoration.

Based on Canalys analyst Le Xuan Chiew, stabilizing inflationary pressures buoyed by authorities help and momentum from year-end 2023 gross sales occasions within the area have seen client sentiment and expenditure rebound.

“To capitalize on this market resurgence, smartphone producers, which adopted conservative methods within the final six months, at the moment are deploying aggressive ways to realize market dominance,” he mentioned within the launch, noting traits corresponding to reasonably priced 5G, AI integration, ecosystem improvement, and channel optimization.

In January, Samsung regained its prime market share spot within the area due to the profitable launch of its premium S24 collection, which provided elevated battery life and new AI capabilities.

However, Chinese language opponents are focusing extra in the marketplace, gaining floor and providing new cellphone fashions at aggressive costs. Xiaomi, the second largest cellphone model by shipments in January for that area, noticed year-on-year progress of 128%, whereas Transsion, a relative newcomer to the market, noticed progress of 190%.

“The area’s rising disposable earnings from an increasing middle-class and younger inhabitants coming into the workforce are robust causes to anticipate elevated investments,” mentioned Cheiw.

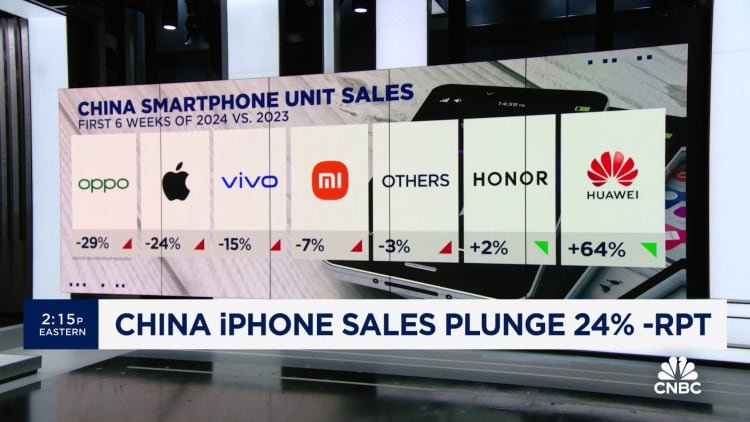

The robust smartphone shipments in Southeast Asia contrasted with China, the most important smartphone market globally, which noticed smartphone gross sales fall 7% within the first six weeks of 2024 year-over-year, based on a Tuesday report from Counterpoint Analysis.

Whereas the decline in gross sales in China was magnified by unusually excessive gross sales in the beginning of 2023, different elements have saved the market down, senior analyst Ivan Lam mentioned within the report.

“Shopper confidence might want to rise to stabilize the market, however it’s a powerful name proper now with all the pieces that’s taking place, particularly in the actual property sector,” he mentioned.

One casualty has been Apple, whose smartphone shipments in China declined 24% within the first six weeks of the yr, based on the analysis. This decline resulted, partially, from the revival of native competitor Huawei, but in addition abnormally excessive shipments by Apple in the beginning of 2023 that resulted from earlier manufacturing delays.

Nevertheless, as progress in smartphone markets like China and the U.S. sluggish, manufacturers that promote premium telephones like Apple and Huawei are more and more seeking to rising markets like Southeast Asia, that are poised for progress.

Based on information from Canalys, Southeast Asia’s cellphone market is forecasted to develop 7% year-over-year in 2024, a a lot quicker fee than that of the remainder of the world, which is at 3%. In the meantime, China is predicted to develop by 1%, and North America’s market is predicted to remain flat.

Based on reporting from Bloomberg, Apple’s first retail location in Malaysia is already within the works. In the meantime, Huawei has been strengthening ties with Southeast Asian companions such because the Indonesian telecommunications firm Telkomsel.

Within the Canalys report, Indonesia remained the most important Southeast Asian smartphone market, making up 38% of shipments in January. The second largest market, the Philippines, confirmed essentially the most strong progress with shipments up 77% in January in comparison with final yr.

The following largest markets have been Thailand, Vietnam, and Malaysia, in that order. Vietnam was the one nation to expertise a year-on-year cargo decline, dropping 2%.