From R-rated sci-fi to teen biker gang adventures, streaming platforms are locked in an intensifying battle for dominance in one of many leisure sector’s hottest and most profitable mediums: anime. Fuelled partly by the pandemic, the recognition of the cartoons pioneered in Japan has created a goldmine for streaming giants corresponding to Netflix, Disney+, and Amazon Prime.

The worldwide anime market was valued at $28.6 billion (about Rs. 2,34,825 crore) in 2022, in accordance with Grand View Analysis, and is forecast to double in worth by 2030. “The height should be forward of us,” Aya Umezu, CEO of Tokyo-based leisure consulting agency GEM Companions, advised AFP. “We doubt the competitors in anime will decelerate quickly.”

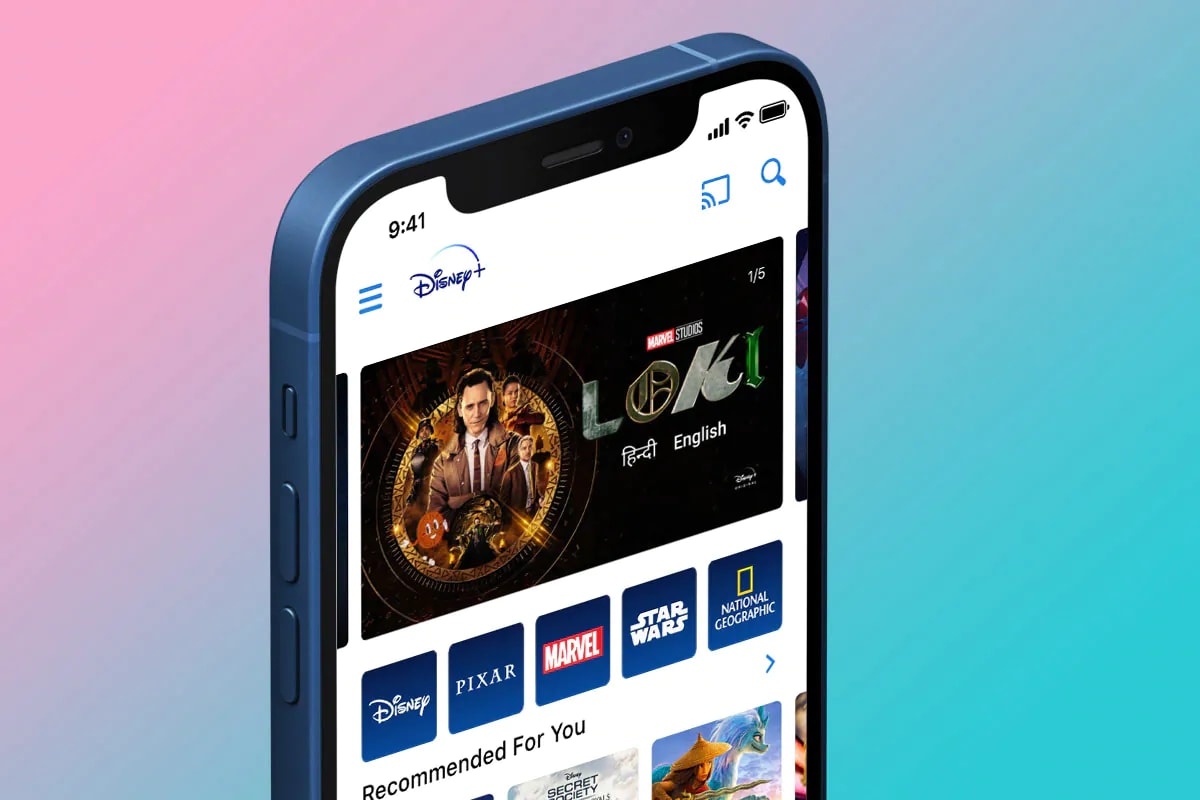

Globally, demand for anime elevated by 35 p.c from 2020 to 2021, in accordance with business specialist service Parrot Analytics. It’s little marvel, then, that worldwide streamers are scrambling for tactics to capitalise on the surging curiosity. Latest years have seen Disney+, a relative latecomer to anime, begin providing fan favourites additionally discovered elsewhere like Demon Slayer, Spy x Household, and Jujutsu Kaisen.

“Having them can stop subscription cancellations — that is how robust these IPs (mental properties) are,” Umezu stated. Providing these titles is seen as a baseline, and much from enough to win the loyalty of anime followers with more and more various choices obtainable. That has meant platforms wish to both safe unique rights to the content material or co-produce their very own authentic anime in a bid to face out.

Breaking open the market

Final 12 months, Disney+ introduced unique streaming rights to season two of the smash-hit teen biker gang saga Tokyo Revengers, a part of a profitable take care of publishing big Kodansha.

Amazon Prime has additionally sought to ‘monopolise’ blockbusters, stated anime knowledgeable Tadashi Sudo, together with One Piece Movie: Pink — Japan’s highest-grossing film final 12 months.

Netflix has confirmed one thing of an outlier on this market, going past snatching up current hits to work straight with animation studios, granting them an uncommon quantity of artistic leeway to make new tales.

Historically, Japanese anime emerges from ‘manufacturing committees’ made up of publishers, TV broadcasters, toy-makers and different business gamers. These have lengthy had a key position in broadening income prospects for a collection, from character merchandising to gaming. Netflix ruffled business feathers when it teamed up straight with Tokyo animation studio Manufacturing I.G in 2018, bypassing the system.

“Some [in the anime industry] have been upset as a result of they thought we might destroy what that they had constructed over all these years,” Manufacturing I.G president Mitsuhisa Ishikawa stated. He went so far as likening Netflix to the ‘Black Ships’ — the Nineteenth-century US vessels that pressured the opening of Japan after tons of of years of commerce isolation. “The home means of creating anime was instantly pressured open,” he stated.

Netflix has reaped the rewards, with its authentic content material making it “the platform that drove the biggest enhance in international demand for anime in 2021”, stated Christofer Hamilton of US-based Parrot Analytics.

‘Experimental’ push

However even streaming goliaths with worldwide affect have comparatively small viewers numbers in Japan. That raises pink flags for some business gamers, particularly publishers who need most publicity for anime variations of their manga titles and fear unique streaming offers would restrict their attain in Japan.

There’s “a conflict of two opposing pursuits — between platforms who need extra exclusives and manufacturing committee gamers who need as little of a monopoly (for streaming companies) as doable”, stated anime specialist Sudo. Consultants say this battle typically results in Netflix authentic offers being based mostly on works which are much less prone to turn out to be nationwide sensations like Demon Slayer.

None of Netflix’s authentic anime made their top-20 most-watched checklist for Japan customers in 2022, in accordance with GEM Companions senior information analyst Shota Ito. The streamer is, nonetheless, a sexy prospect for studios with extra commercially difficult initiatives that the normal market may discover too area of interest.

Early authentic content material on Netflix mirrored this, and was heavy on exhibits critics say evoked the hardcore sci-fi anime of some a long time in the past. Amongst these was Devilman Crybaby, the story of a ‘demon-boy’ that featured violence and nudity galore.

“My sense is that creators wished to do one thing with us that that they had little probability to do beneath the present system,” Netflix chief anime producer Taiki Sakurai advised AFP. That preliminary ‘experimental’ push has since given option to a broader roster, together with comedy, conventional ‘shonen’ focusing on younger boys and even a stop-motion undertaking starring a teddy bear. Lengthy-standing followers additionally produce other devoted companies to show to, together with the massive on-line anime library Crunchyroll.

Netflix content material director Yuji Yamano is satisfied the market is much from saturated, although, and believes competitors will solely make “the business much more thrilling”. “Globally, I solely see extra room for development in anime.”