Putting Writers Guild of America (WGA) members stroll the picket line in entrance of Netflix places of work as SAG-AFTRA union introduced it had agreed to a ‘last-minute request’ by the Alliance of Movement Image and Tv Producers for federal mediation, nevertheless it refused to once more lengthen its current labor contract previous the 11:59 p.m. Wednesday negotiating deadline, in Los Angeles, California, July 12, 2023.

Mike Blake | Reuters

Conventional TV is dying. Advert income is mushy. Streaming is not worthwhile. And Hollywood is virtually shut down because the actors and writers unions settle in for what’s shaping as much as be a protracted and bitter work stoppage.

All of this turmoil will probably be on traders’ minds because the media business kicks off its earnings season this week, with Netflix up first on Wednesday.

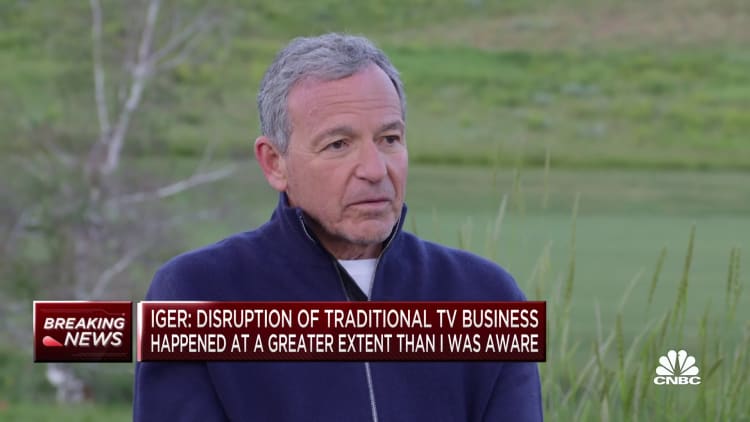

Netflix, with a brand new promoting mannequin and push to cease password sharing, seems the very best positioned in comparison with legacy media giants. Final week, for example, Disney CEO Bob Iger prolonged his contract by way of 2026, telling the market he wanted extra time on the Mouse Home to deal with the challenges earlier than him. On the high of the listing is contending with Disney’s TV networks, as that a part of the enterprise seems to be in a worse state than Iger had imagined. “They will not be core to Disney,” he stated.

“I believe Bob Iger’s feedback had been a warning in regards to the quarter. I believe they’re very worrying for the sector,” stated analyst Michael Nathanson of SVB MoffettNathanson following Iger’s interview with CNBC’s David Faber on Thursday.

Though the mushy promoting market has been weighing on the business for some quarters now, the current introduction of a less expensive, ad-supported choice for companies like Netflix and Disney+ will doubtless be one brilliant spot as one of many few areas of development and focus this quarter, Nathanson stated.

Iger has talked at size in current investor calls and Thursday’s interview about how promoting is a part of the plan to carry Disney+ to profitability. Others, together with Netflix, have echoed the identical sentiment.

Netflix will report earnings after the shut Wednesday. Wall Road will probably be eager to listen to extra particulars in regards to the rollout of its password sharing crackdown within the U.S. and state of its newly launched ad-supported choice. The corporate’s inventory is up almost 50% this yr, after a correction in 2022 that adopted its first subscriber loss in a decade

Investor focus will even be on legacy media corporations like Paramount World, Comcast Corp. and Warner Bros. Discovery, which every have important portfolios of pay-TV networks, following Iger’s feedback that conventional TV “will not be core” to the corporate and all choices, together with a sale, had been on the desk. These corporations and Disney will report earnings within the weeks forward.

Strike woes

Scene from “Squid Sport” by Netflix

Supply: Netflix

Only a week forward of the earnings kickoff, members of The Display Actors Guild – American Federation of Tv and Radio Artists joined the greater than 11,000 already-striking movie and tv writers on the picket line.

The strike – a results of the failed negotiations with the Alliance of Movement Image and Tv Producers – brings the business to a right away halt. It is the primary twin strike of this sort since 1960.

The labor battle blew up simply because the business has moved away from streaming development in any respect prices. Media corporations noticed a lift in subscribers – and inventory costs – earlier within the pandemic, investing billions in new content material. However development has since stagnated, leading to finances cuts and layoffs.

“The strike occurring suggests it is a sector in great turmoil,” stated Mark Boidman, head of media and leisure funding banking at Solomon Companions. He famous shareholders, notably hedge funds and institutional traders, have been “very annoyed” with media corporations.

Iger informed CNBC final week the stoppage could not happen at a worse time, noting “disruptive forces on this enterprise and all of the challenges that we’re dealing with,” on high of the business nonetheless recovering from the pandemic.

These are the primary strikes of their type throughout the streaming period. The final writers strike occurred in 2007 and 2008, which went on for about 14 weeks and gave rise to unscripted, actuality TV. Hollywood writers have already been on strike since early Might of this yr.

Relying on the longevity of the strike, recent movie and TV content material might dry up and go away streaming platforms and TV networks – apart from library content material, dwell sports activities and information – naked.

For Netflix, the strikes could have a lesser impact, at the least within the near-term, Insider Intelligence analyst Ross Benes stated. Content material made outdoors the U.S. is not affected by the strike — an space the place Netflix has closely invested.

“Netflix is poised to do higher than most as a result of they produce reveals so effectively upfront. And if push involves shove, they’ll depend on worldwide reveals, of which they’ve so many,” stated Benes. “Netflix is the antagonist within the eyes of strikes due to the way it modified the economics of what writers receives a commission.”

Conventional TV doom

The decline of pay-TV subscribers, which has ramped up in current quarters, ought to proceed to speed up as shoppers more and more shift towards streaming.

But, regardless of the rampant decline, many networks stay money cows, and so they additionally provide content material to different components of the enterprise — notably streaming.

For pay-TV distributors, mountain climbing the value of cable bundles has been a technique of staying worthwhile. However, based on a current report from MoffettNathanson, “the amount of subscribers is falling far too quick for pricing to proceed to offset.”

Iger, who started his profession in community TV, informed CNBC final week that whereas he already had a “very pessimistic” view of conventional TV earlier than his return in November, he has since discovered it is even worse than he anticipated. The chief stated Disney is assessing its community portfolio, which incorporates broadcaster ABC and cable channels like FX, indicating a sale could possibly be on the desk.

Paramount is at the moment contemplating a sale of a majority stake in its cable-TV community BET. In recent times Comcast’s NBCUniversal has shuttered networks like NBC Sports activities and mixed sports activities programming on different channels like USA Community.

“The networks are a dwindling enterprise, and Wall Road does not like dwindling companies,” stated Nathanson. “However for some corporations, there isn’t any method round it.”

Making issues worse, the weak promoting market has been a supply of ache, notably for conventional TV. It weighed on the earnings of Paramount and Warner Bros. Discovery in current quarters, every of which have large portfolios of cable networks.

Promoting pricing development, which has lengthy offset viewers declines, is a key supply of concern, based on MoffettNathanson’s current report. The agency famous that this could possibly be the primary non-recessionary yr that promoting upfronts do not produce will increase in TV pricing, particularly as ad-supported streaming hits the market and zaps up stock.

Streamers’ introduction of cheaper, ad-supported tiers will probably be a scorching subject as soon as once more this quarter, particularly after Netflix and Disney+ introduced their platforms late final yr.

“The mushy promoting market impacts everybody, however I do not suppose Netflix is as affected because the TV corporations or different established promoting streamers,” stated Benes. He famous whereas Netflix is probably the most established streamer, its advert tier is new and has loads of room for development.

Promoting is now thought-about an essential mechanism in platforms’ broader efforts to succeed in profitability.

“It is not a coincidence that Netflix all of a sudden grew to become even handed about freeloaders whereas pushing a less expensive tier that has promoting,” stated Benes, referring to Netflix’s crackdown on password sharing. “That is fairly frequent within the business. Hulu’s advert plan will get extra income per consumer than the plan with out promoting.”

Are extra mergers coming?

Final week’s ruling from a federal decide that Microsoft’s $68.7 billion acquisition of recreation writer Activision Blizzard ought to transfer ahead serves as a uncommon piece of fine information for the media business. It is a sign that important consolidation can proceed even when there’s short-term regulatory interference.

Though the Federal Commerce Fee appealed the ruling, bankers took it as a win for dealmaking throughout a gradual interval for megadeals.

“This was a pleasant win for bankers to enter board rooms and say we’re not in an atmosphere the place actually engaging M&A goes to be shot down by regulators. It is encouraging,” stated Solomon Companions’ Boidman.

As media giants wrestle and shareholders develop annoyed, the decide’s ruling might gasoline extra offers as “a variety of these CEOs are on the defensive,” Boidman added.

Regulatory roadblocks have been prevalent past the Microsoft deal. A federal decide shut down e book writer Penguin Random Home’s proposed buy of Paramount’s Simon & Schuster final yr. Broadcast station proprietor Tegna scrapped its sale to Customary Basic this yr resulting from regulatory pushback.

“The truth that we’re so centered on the Activision-Microsoft deal is indicative of a actuality that dealmaking goes to be an unlimited device going ahead to solidify market place and soar your organization inorganically in methods you could not do your self,” stated Jason Anderson, CEO of Quire, a boutique funding financial institution.

These CEOs will not simply do a deal to do a deal. From this level ahead, it’ll take a better bar to consolidate.

Peter Liguori

former Tribune Media CEO

Anderson famous bankers are all the time fascinated by regulatory pushback, nevertheless, and it should not essentially be the explanation offers do not come collectively.

Warner Bros. and Discovery merged in 2022, ballooning the mixed firm’s portfolio of cable networks and bringing collectively its streaming platforms. Just lately, the corporate relaunched its flagship service as Max, merging content material from Discovery+ and HBO Max. Amazon purchased MGM the identical yr.

Different megadeals occurred earlier than that, too. Comcast acquired U.Ok. broadcaster Sky in 2018. The subsequent yr, Disney paid $71 billion for Fox Corp.’s leisure belongings – which gave Disney “The Simpsons” and a controlling stake in Hulu, however makes up a small portion of its TV properties.

“The Simpsons”: Homer and Marge

Getty / FOX

“The Road and prognosticators overlook that Comcast and Sky, Disney and Fox, Warner and Discovery —occurred just some years in the past. However the business talks as if these offers occurred in BC not AD instances,” stated Peter Liguori, the previous CEO of Tribune Media who’s a board member at TV measurement agency VideoAmp.

Consolidation is prone to proceed as soon as corporations are completed working by way of these previous mergers and get previous lingering results of the pandemic, corresponding to elevated spending to achieve subscribers, he stated. “These CEOs will not simply do a deal to do a deal. From this level ahead, it’ll take a better bar to consolidate.”

Nonetheless, with the rise of streaming and its lack of profitability and bleeding of pay-TV clients, extra consolidation could possibly be on the best way, it doesn’t matter what.

Whether or not M&A helps push these corporations ahead, nevertheless, is one other query.

“My kneejerk response to the Activision-Microsoft ruling was there’s going to be extra M&A if the FTC goes to be defanged,” Nathanson stated. “However reality be informed, Netflix constructed its enterprise with licensing content material and never having to purchase an asset. I am not likely positive the massive transactions to purchase studios have labored out.”

–CNBC’s Alex Sherman contributed to this text.

Disclosure: Comcast owns NBCUniversal, the father or mother firm of CNBC.