Taiwan performs a crucial position within the AI chip revolution and the worldwide semiconductor business, the chief government of the Taiwan Inventory Change instructed CNBC in an unique interview.

Sherman Lin, chairman and CEO of Taiwan Inventory Change Company attributed the sturdy features on the Taiwan Weighted Index to “the AI revolution.”

“It’s simply because [of] the excessive demand of the high-end chip, and in addition the server provide chain. That is why our inventory market goes up,” he stated.

The Taiex has risen 27.93% within the final 12 months, however gave up some features on Friday after most main markets within the area sank amid rising Center East tensions.

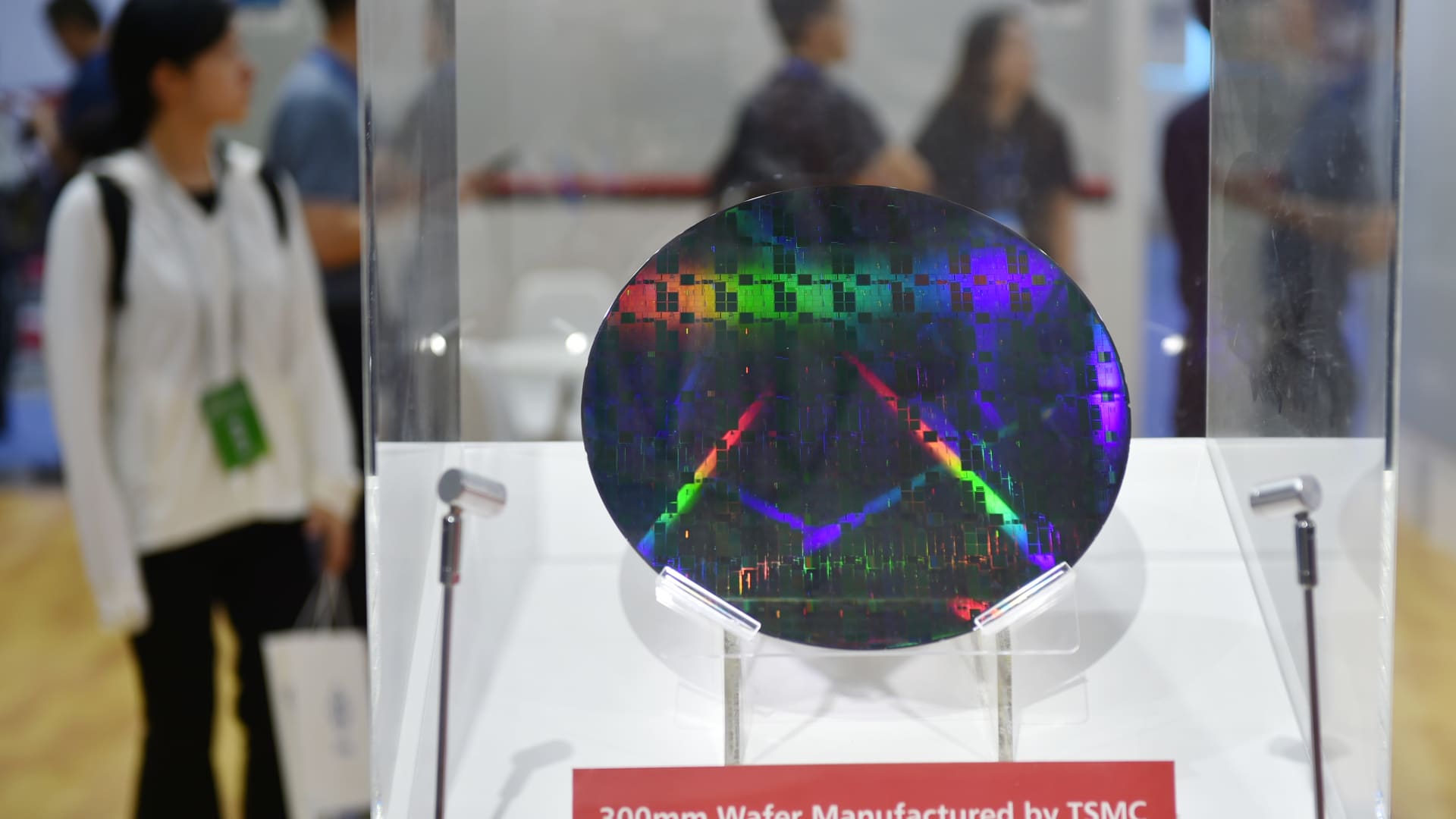

A lot of Taiwan’s dominance within the international semiconductor business may be attributed to Taiwan Semiconductor Manufacturing Co, the world’s largest contract chipmaker that produces superior processors for shoppers like Apple and Nvidia. TSMC is the primary producer of Nvidia’s highly effective AI processors.

“I feel it is a lot of attraction for buyers … So it means, truly, Taiwan performs [a] very essential position in AI provide chain and in addition the semiconductor business,” stated Lin.

Taiwan’s chip dominance

In 2023, Taiwan led superior chip manufacturing expertise, together with 16- or 14-nanometer and extra superior processes, with 68% international capability share, in line with TrendForce knowledge. This was adopted by the U.S. (12%), South Korea (11%), and China (8%), the information confirmed.

Taiwan additionally held practically 80% market share in excessive ultraviolet technology processes, similar to 7-nanometer and extra superior expertise, stated TrendForce. The smaller the nanometer dimension, the extra highly effective the chip is. EUV instruments are crucial within the manufacturing of the world’s most superior processors.

“We’ve got superb fundamentals of ICT industries. So we will have the energy to facilitate, leveraging the success of the ICT and expertise industries, new financial system enterprise,” stated Lin.

Quake and geopolitical dangers

Earlier this month, Taiwan was hit by its strongest earthquake in 25 years. TSMC stated building websites had been regular upon preliminary inspection, although employees from some fabs had been briefly evacuated. These employees subsequently returned to their workplaces.

“Taiwan exhibits superb resilience … I perceive that some listed firms that report back to the TWSE – they’d little or no affect on their productions,” stated Lin.

“The sort of the problem for Taiwan is the testing for our enterprise continuity plan. We truly did fairly properly. And we refreshed, we responded actually rapidly. So you may see within the capital market, you may see the adjusted rebound fairly quickly,” stated Lin.

“Proper now, it is nonetheless within the uptrend within the capital market after the earthquake.”

On the end result of the U.S. elections and navy conflicts, Lin stated such conditions “will at all times have an effect on some capital markets” in addition to the Taiwan market.

“However [as] you may see, it can return to the basics. So I feel Taiwan has good fundamentals, [has] resilience and [responds] rapidly. I’m fairly assured about our capital markets,” stated Lin.