One of many messages that Warren Buffett and Berkshire Hathaway’s high insurance coverage government, Ajit Jain, despatched to buyers through the firm’s annual shareholder assembly in Omaha final month was that cyber insurance coverage, whereas presently worthwhile, nonetheless has too many unknowns and dangers for Berkshire, an enormous participant within the insurance coverage market, to be totally comfy underwriting.

Cyber insurance coverage has change into “a really trendy product,” Jain stated on the annual assembly. And it has been a cash maker for insurers, a minimum of thus far. He described present profitability as “pretty excessive” — a minimum of 20% of the overall premium ending up within the pockets of insurers. However at Berkshire, the message being despatched to brokers is one in all warning. A major motive is the problem in assessing how losses from a single prevalence do not spiral into an aggregation of potential cyber losses. Jain gave the hypothetical instance of when a significant cloud supplier’s platform “involves a standstill.”

“That aggregation potential could be enormous, and never having the ability to have a worst-case hole on it’s what scares us,” he stated.

“There is no place the place that sort of a dilemma enters into greater than cyber,” Buffett stated. “You could get an aggregation of dangers that you just by no means dreamt of, and possibly worse than some earthquake occurring someplace.”

Berkshire is within the cyber insurance coverage enterprise

Trade analysts typically say whereas a few of Berkshire’s warning is warranted, the final state of the cybersecurity insurance coverage market is stabilizing because it turns into worthwhile. And Gerald Glombicki, a senior director in Fitch Score’s U.S. insurance coverage group, factors out that Berkshire Hathaway is issuing cybersecurity insurance policies regardless of Buffett’s warning. In line with Fitch’s evaluation, Berkshire Hathaway is the sixth-largest issuer of such insurance policies. Chubb, which Berkshire lately revealed an enormous funding in, and AIG are the most important.

“Proper now [cybersecurity insurance] continues to be a viable enterprise mannequin for a lot of insurers,” Glombicki stated. It’s nonetheless a tiny market, representing just one p.c of all insurance policies issued, in response to Glombicki. As a result of the cybersecurity enterprise is so small, it provides insurance coverage corporations latitude to implement numerous insurance policies to see what’s working, and what is not, and not using a large quantity of publicity.

Berkshire, in addition to Chubb and AIG, declined to remark.

“There is a component of unpredictability that may be very unsettling, and I perceive the place [Buffett] is coming from, however I believe it’s actually exhausting to keep away from cyber threat fully,” Glombicki stated. He added although that there has nonetheless been no vital litigation that assigns culpability or exams the boundaries of the insurance policies, and till the courts hear some culpability instances, some insurers might proceed extra cautiously.

‘Might break the corporate’ Buffett says

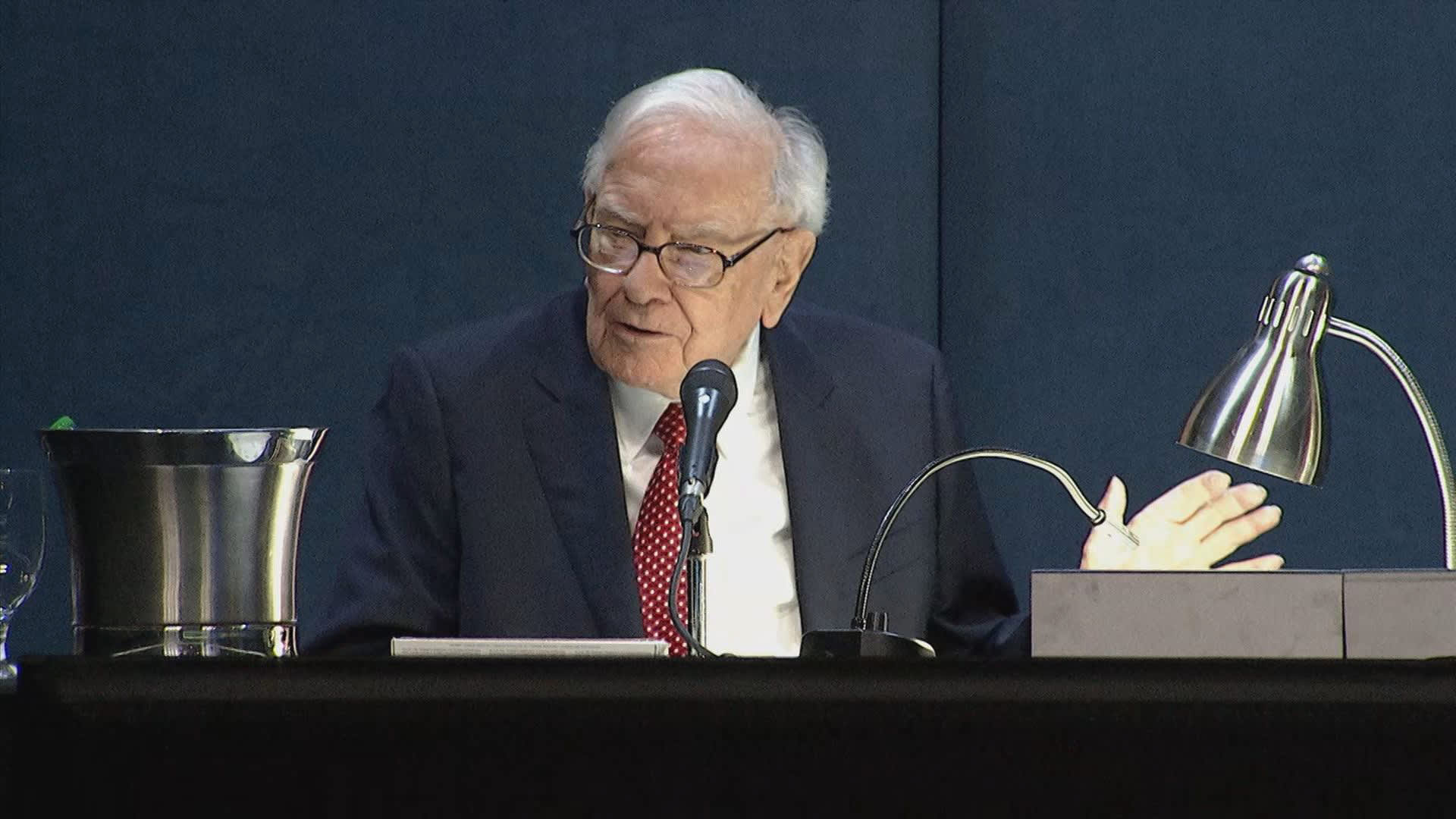

Prime Berkshire executives Warren Buffett (L), Greg Abel (C) and Ajit Jain (R) through the Berkshire Hathaway Annual Shareholders Assembly in Omaha, Nebraska on Might 4, 2024.

CNBC

The issue with writing many insurance policies, even with a $1 million restrict per coverage, is that if a “single occasion” seems to have an effect on 1,000 insurance policies. “You have written one thing that under no circumstances we’re getting the correct value for, and will break the corporate,” Buffett stated.

Whereas some notable leaders, like former Homeland Safety chief Michael Chertoff — who now runs a world safety threat administration agency — have known as for a authorities cybersecurity backstop of some kind, most consultants do not consider that’s wanted proper now. Glombicki says that whereas the feds are taking a look at what position they’ll play, intervention seemingly will not occur till an incident prompts it.

Any authorities involvement “will most likely occur after an enormous, costly cyber-incident,” he stated. “After September 11, the federal government put collectively a terrorist threat program. In cyber, we’ve got not but seen an assault of that scale. We’re nonetheless within the stage of excited about doable approaches.”

Cyber insurance coverage information exhibits progress and market confidence

Whereas the variety of cybersecurity insurance policies being written is small now, analysts do not anticipate it to remain that method.

“Charges are declining, which exhibits stability out there,” stated Mark Friedlander, a spokesman for the Insurance coverage Data Institute. In line with its information, cyber premiums are estimated to double over the subsequent decade. In 2022, premiums totaled $11.9 billion. By 2025, Friedlander says, they’re anticipated to double to $22.5 billion and improve to $33.3 billion by 2027.

“That is clearly one of many fastest-growing segments of insurance coverage. Extra corporations are writing cybersecurity insurance policies than ever earlier than,” Friedlander stated, attributing confidence amongst insurers to extra subtle underwriting and stabilizing charges. He cited a 6% decline in cybersecurity insurance coverage charges within the first quarter of 2024, following a 3% decline in 2024, as a transparent sign that insurers really feel extra assured about leaping into the enterprise.

“Most industrial insurance coverage like auto, dwelling, and life insurance coverage have all been growing, so the decline is critical. It’s a signal of stability and a decline in claims severity,” Friedlander stated.

And extra insurers are coming into the market as a result of they’ve the instruments and information to cost the chance. “If you are able to do it at sound charges, you’ll write that protection,” Friedlander stated.

‘You are dropping cash’

Buffett and his high insurance coverage lieutenant do not agree. It is the insurance coverage “loss price” — what the price of items bought may doubtlessly be — that has Berkshire on the fence with a much bigger transfer into cyber insurance coverage. Jain stated losses have been “pretty properly contained” thus far — not exceeding 40 cents on the coverage greenback over the previous 4 to 5 years — however he added, “there’s not sufficient information to have the ability to grasp your hat on and say what your true loss price is.”

Jain stated that generally brokers are Berkshire are discouraged from writing cyber insurance coverage, until they should write it to fulfill particular shopper wants. And even when they do, Jain leaves them with this message: “Regardless of how a lot you cost, it’s best to inform your self that every time you write a cyber insurance coverage coverage, you are dropping cash. We will argue about how a lot cash you are dropping, however the mindset needs to be you are not earning money on it. … After which we should always go from there.”

Google Cloud says the dangers are being overstated

There’s a notion that cyber threat is quickly altering and, subsequently, too unpredictable to underwrite in a scientific method, says Monica Shokrai, head of enterprise threat and insurance coverage at Google Cloud. However she added that the notion would not match actuality, and that the chance can largely be managed.

“We do not maintain the identical view as Warren Buffet on the subject,” she stated. In Google’s view, nearly all of cyber losses could be prevented or mitigated by means of fundamental cyber hygiene.

“By understanding safety, you may get to a spot the place your controls are in a a lot better place, the place the chance is extra manageable,” Shokrai stated. Devastating assaults from nation-states, in the meantime, are in a separate class and have been uncommon. Insurers are already inoculating themselves from potential threat by making exclusions for sure catastrophic occasions. Many cybersecurity insurance policies have protection exemptions for nation-state assaults.

“What they’re attempting to do is stay resilient and solvent within the occasion of a widespread occasion; what they’ve executed to handle that’s put in exclusions,” Shokrai stated, and people embrace crucial infrastructure, cyber warfare, and different widespread disruptive occasions.

Ambiguities and subjectivities stay. What if somebody is the sufferer of a cyberattack from a foreign-based gang that is not formally tied to a nation-state however might have obtained some ancillary logistical help? Can an insurance coverage firm invoke a nation-state exclusion? Shokrai says categorizing attribute an occasion is the subject of a lot debate between insurance coverage corporations. “That may be a large debate between insurance coverage corporations; it is a crucial distinction that wants readability,” Shokrai stated.

Some consultants say it’s the ambiguity surrounding the trade’s margins that has buyers like Buffett and insurance coverage gamers like Berkshire spooked. However thus far, the enterprise has confirmed to be sound general. “It’s nonetheless a viable enterprise mannequin for a lot of insurers,” stated Josephine Wolff, an affiliate professor of cybersecurity coverage at The Fletcher Faculty at Tufts College, who has been learning the evolving marketplace for the previous a number of years. However she added {that a} perception that the enterprise is viable does not imply issues are usually not always altering, pointing to the latest ransomware surge over the previous couple of years that noticed giant payouts by insurance coverage corporations — although notably nonetheless not sufficient to make the enterprise unprofitable for many issuers.

Cyber insurance coverage helps make your complete ecosystem safer, in response to Steve Griffin, co-founder of L3 Networks, a California-based managed providers supplier that focuses on cybersecurity. Insurance policies require corporations to stick to sure cyber requirements to realize protection, and the extra companies that join protection, the safer your complete system turns into. And if a enterprise is aware of they will be denied a declare if they do not have some fundamental cybersecurity safeguards in place, that acts as an incentive to place them in place.

Berkshire does consider the enterprise will develop, it simply is not certain at what price. “My guess is in some unspecified time in the future it would change into an enormous enterprise, however it is likely to be related to enormous losses,” Jain stated.

“I’ll let you know that most individuals need to be in something that is trendy after they write insurance coverage. And cyber’s a straightforward situation,” Buffett stated. “You’ll be able to write quite a lot of it. The brokers prefer it. They’re getting the fee on each coverage they write. … I might say that human nature is such that almost all insurance coverage corporations will get very excited and their brokers will get very excited, and it is very trendy and it is sort of fascinating, and as Charlie [Munger] would say, it might be rat poison.”

Whereas Griffin understands Buffett’s warning, he sees a generational divide over the chance outlook, and is optimistic in regards to the cybersecurity insurance coverage sector.

“Most likely Warren Buffet would have known as cybersecurity insurance coverage a possibility when he was youthful,” he stated.