A Chevron fuel station is proven in Austin, Texas, on Oct. 23, 2023.

Brandon Bell | Getty Photographs Information | Getty Photographs

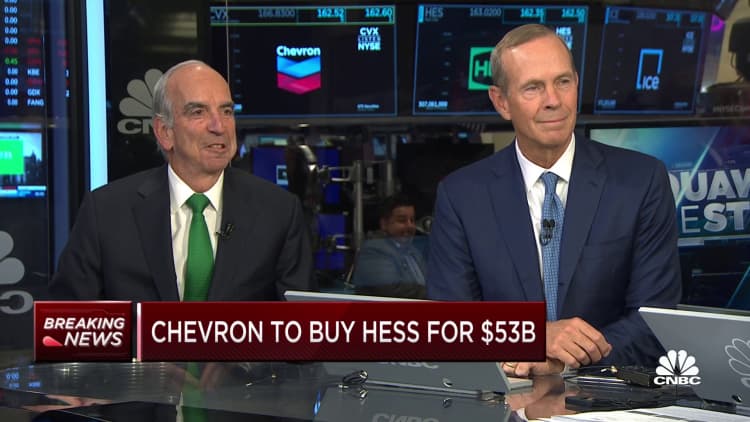

On Monday, Chevron introduced plans to accumulate oil and fuel firm Hess for $53 billion in inventory.

Lower than two weeks prior, Exxon Mobil introduced it’s buying oil firm Pioneer Pure Sources for $59.5 billion in inventory.

On Tuesday, the Worldwide Power Company launched its annual world vitality outlook report that tasks international demand for coal, oil and pure fuel will hit an all-time excessive by 2030, a prediction the IEA’s government director Fatih Birol had telegraphed in September.

“The transition to wash vitality is occurring worldwide and it is unstoppable. It is not a query of ‘if,’ it is only a matter of ‘how quickly’ — and the earlier the higher for all of us,” Birol stated in a written assertion printed alongside his company’s world outlook. “Bearing in mind the continued strains and volatility in conventional vitality markets right this moment, claims that oil and fuel symbolize protected or safe decisions for the world’s vitality and local weather future look weaker than ever.”

However based mostly on their acquisitions, Chevron and Exxon are seemingly making ready for a unique world than the IEA is portending.

“The big firms — nongovernment firms — don’t see an finish to grease demand any time within the close to future. That is one of many messages it’s a must to take from this. They’re dedicated to the trade, to manufacturing, to reserves and to spending,” Larry J. Goldstein, a former president of the Petroleum Business Analysis Basis and a trustee with the not-for-profit Power Coverage Analysis Basis, advised CNBC in a telephone dialog Monday.

“They’re on this within the lengthy haul. They do not see oil demand declining anytime within the close to time period. They usually see oil demand in pretty massive volumes present for at the very least the subsequent 20, 25 years,” Goldstein advised CNBC. “There is a main distinction between what the massive oil firms consider the way forward for oil is and the governments around the globe.”

So, too, says Ben Cahill, a senior fellow within the vitality safety and local weather change program on the bipartisan, nonprofit coverage analysis group, Heart for Strategic and Worldwide Research.

“There are countless debates about when ‘peak demand’ will happen, however for the time being, international oil consumption is close to an all-time excessive. The biggest oil and fuel producers in america see a protracted pathway for oil demand,” Cahill advised CNBC.

Pioneer Pure Sources crude oil storage tanks close to Midland, Texas, on Oct. 11, 2023.

Bloomberg | Bloomberg | Getty Photographs

Africa, Asia driving demand

Globally, momentum behind and funding in clear vitality is growing. In 2023, there will probably be $2.8 trillion invested within the international vitality markets, in keeping with a prediction from the IEA in Could, and $1.7 trillion of that’s anticipated to be in clear applied sciences, the IEA stated.

The rest, a bit greater than $1 trillion, will go into fossil fuels, resembling coal, fuel and oil, the IEA stated.

Continued demand for oil and fuel regardless of rising momentum in clear vitality is because of inhabitants development across the globe and specifically, development of populations “ascending the socioeconomic ladder” in Africa, Asia and to some extent Latin America, in keeping with Shon Hiatt on the USC Marshall Faculty of Enterprise.

Oil and fuel are comparatively low cost and straightforward to maneuver round, significantly as compared with constructing new clear vitality infrastructure.

“These firms consider within the long-term viability of the oil and fuel trade as a result of hydrocarbons stay essentially the most cost-effective and simply transportable and storable vitality supply,” Hiatt advised CNBC. “Their technique means that in rising economies marked by inhabitants and financial enlargement, the adoption of low-carbon vitality sources could also be prohibitively costly, whereas hydrocarbon demand in European and North American markets, though doubtlessly diminished, will stay a big issue.”

Additionally, whereas electrical automobiles are rising in reputation, they’re only one part of the transportation pie, and lots of the different sections of the transportation sector will proceed to make use of fossil fuels, stated Marianne Kah, senior analysis scholar and board member at Columbia College’s Heart on World Power Coverage. Kah was beforehand the chief economist of ConocoPhillips for 25 years.

“Whereas there may be lots of media consideration given to the growing penetration of electrical passenger automobiles, international oil demand continues to be anticipated to develop within the petrochemical, aviation and heavy-duty trucking sectors,” Kah advised CNBC.

Geopolitical pressures additionally play a task.

Exxon and Chevron are increasing their holdings as European oil and fuel majors usually tend to be topic to strict emissions rules. The U.S. is unlikely to have the political will to power the identical type of stringent rules on oil and fuel firms right here.

“One may speculate that Exxon and Chevron are anticipating the European oil majors divesting their international reserves over the subsequent decade because of European coverage modifications,” Hiatt advised CNBC.

“They’re additionally betting home politics won’t permit the U.S. to take vital new local weather insurance policies directed particularly to restrain or restrict or ban the extent of U.S. oil and fuel home manufacturing,” Amy Myers Jaffe, a analysis professor at New York College and director of the Power, Local weather Justice and Sustainability Lab at NYU’s Faculty of Skilled Research, advised CNBC.

Goldstein expects the ever-expanding U.S. nationwide debt will ultimately put all types of presidency subsidies on the chopping block, which he says may also profit firms resembling Exxon and Chevron.

“All subsidies will probably be below huge strain,” Goldstein stated, the depth of that strain depending on which social gathering is within the White Home at any given time. “By the best way, meaning the big monetary oil firms will be capable to climate that surroundings higher than the smaller firms.”

Additionally, sanctions of state-controlled oil and fuel firms in international locations like these in Russia, Venezuela and Iran are offering Exxon and Chevron a geopolitical opening, Jaffe stated.

“They probably hope that any geopolitically pushed market shortfalls to come back might be crammed by their very own manufacturing, even when demand for oil total is diminished by means of decarbonization insurance policies around the globe,” Jaffe advised CNBC. “When you think about oil like the sport of musical chairs, Exxon Mobil and Chevron are betting that different international locations will fall out of the sport whatever the variety of chairs and that there will probably be sufficient chairs left for the American corporations to take a seat down, every time the music stops.”

An oil pumpjack pulls oil from the Permian Basin oil discipline in Odessa, Texas, on March 14, 2022.

Joe Raedle | Getty Photographs Information | Getty Photographs

Oil that may be tapped rapidly is a precedence

Identified oil reserves are more and more useful as European and American governments look to restrict the exploration for brand spanking new oil and fuel reserves, in keeping with Hiatt.

“Notably, each Pioneer and Hess possess engaging, well-established oil and fuel reserves that provide the potential for vital enlargement and diversification for Exxon and Chevron,” Hiatt advised CNBC.

Oil and fuel reserves that may be dropped at market comparatively rapidly “are the best candidates for manufacturing when there may be uncertainty in regards to the tempo of the vitality transition,” Kah advised CNBC, which explains Exxon’s acquisition of Pioneer, which gave Exxon extra entry to “tight oil,” or oil present in shale rock, within the Permian basin.

Shale is a type of porous rock that may maintain pure fuel and oil. It is accessed with hydraulic fracking, which entails taking pictures water combined with sand into the bottom to launch the fossil gasoline reserves held therein. Hydrocarbon reserves present in shale might be dropped at market between six months and a 12 months, the place exploring for brand spanking new reserves in offshore deep water can take 5 to seven years to faucet, Jaffe advised CNBC.

“Chevron and Exxon Mobil need to cut back their prices and decrease execution threat by means of growing the share of brief cycle U.S. shale reserves of their portfolio,” Jaffe stated. Having reserves which are simpler to deliver to market provides oil and fuel firms elevated means to be attentive to swings within the worth of oil and fuel. “That flexibility is engaging in right this moment’s unstable worth local weather,” Jaffe advised CNBC.

Chevron’s buy of Hess additionally provides Chevron entry in Guyana, a rustic in South America, which Jaffe additionally says is fascinating as a result of it’s “a low price, near dwelling prolific manufacturing area.”

Do not miss these CNBC PRO tales: